Listen to this article on the AGB Soundboard App

Centuries ago, universities transformed their future by realizing that knowledge alone wasn’t enough to sustain their mission, they needed enduring capital. From medieval Oxford and Cambridge’s land grants to Harvard’s first bequest in 1638, the concept of the university endowment emerged as a revolutionary idea: preserve and grow resources so that learning could thrive in perpetuity. What began as gifts of property and money evolved into sophisticated, professionally managed investment funds that today underpin institutional resilience and ambition.

Now, higher education faces a new frontier. Data has become the modern institution’s most valuable yet underleveraged asset, rich with potential to inform strategy, deepen relationships, and drive mission impact. Just as endowments once required a mindset shift from spending to stewardship, universities will now need to treat data as an enduring asset, to be generated and cultivated with the same long-term vision.

The Compounding Nature of Data

Wealth grows through compounding, interest upon interest, gains upon gains. Data compounds in the same way: one record begets context, context begets insight, and insight begets smarter action that generates more data. Over time, this cycle produces exponential institutional intelligence.

But for that compounding to work, data must be treated not as exhaust or a byproduct of activity, but as capital. In finance, the discipline lies in reinvesting returns; in data, it lies in reinvesting learnings. Every interaction, donation, or inquiry creates a data point. When those points are captured, then integrated and analyzed, they become the foundation for predictive understanding and strategic foresight.

Understanding the Data Growth

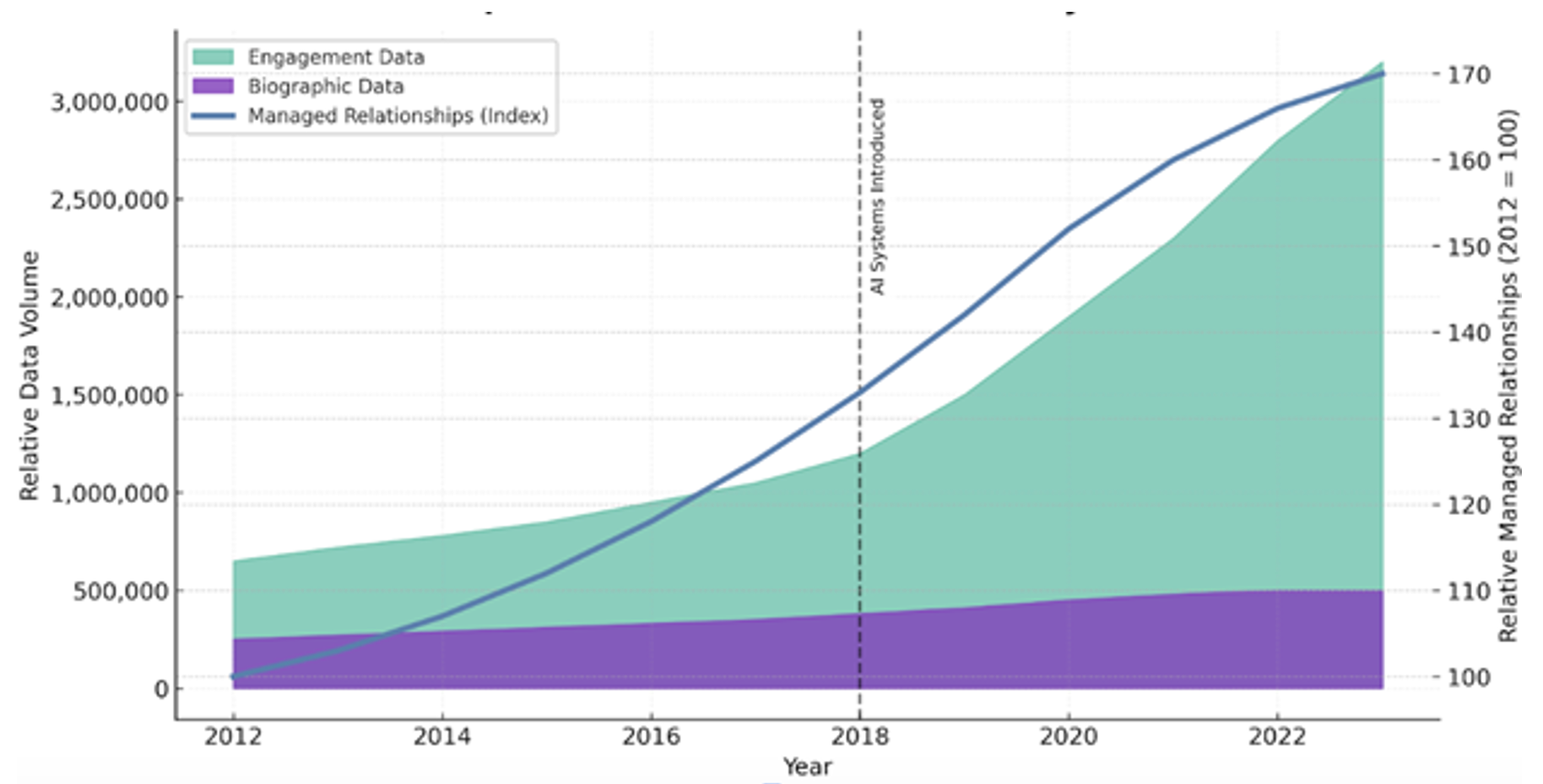

As shown in the chart below, biographic data grows steadily as institutions enroll new students, update alumni records, and record life changes such as career moves or new addresses. It’s foundational but finite, capturing who someone is more than how they engage.

Engagement data, by contrast, expands continuously. Each opened email, event registration, or interaction adds depth and context. As institutions improve their ability to capture and connect these signals, the growth becomes exponential. Engagement data compounds, feeding a cycle of learning and personalization.

The result is a measurable increase in managed relationships. When institutional advancement brings biographic and engagement data together, they can prioritize outreach, deepen connection, and sustain relationships at scale. What emerges isn’t just operational efficiency, but also strategic capacity.

In effect, institutions that invest in capturing, connecting, and learning from engagement data are building a new form of enduring capital, a sort of digital endowment that grows smarter with every interaction.

Representative Growth of Institutional Advancement Data

Figure 1: Fundmetric’s analysis across university advancement data shows that biographic data grows steadily but remains finite, while engagement data compounds as more meaningful interactions are captured. The result is an expanding capacity to manage relationships, and evidence that institutions investing in connected, actionable data are building data capital that strengthens over time.

Data as a Store of Value

In economics, money became transformative when it was accepted as a store of value. Trading coins for coffee is efficient because both parties agree on its worth. Before that consensus, commerce relied on bartering, which was a less efficient exchange of chickens for beans.

Data holds the same potential in modern marketing and institutional advancement. The true value of Facebook isn’t that it connects people but that it knows who is connected to whom. Every connection is a data point, and every comparison between those connections creates layers of understanding. This network of information transforms data from a thing into a currency or a store of relational and behavioral value.

Just as money’s utility depends on its acceptance, data’s power depends on its recognition as an asset. The institutions that acknowledge this are already building the equivalent of data endowments, self-sustaining systems that grow in intelligence, insight, and strategic capacity over time.

Governance: From Ownership to Stewardship

Organizations can’t treat data as capital unless they first know where it lives, who controls it, and how it flows. In most institutions, information becomes trapped in systems or siloed by departments that lack communication capacity. A datal endowment isn’t a single database but a culture of interoperability and shared responsibility.

Strong data governance frameworks are now as essential as investment policies once were. They define access, accountability, and use, ensuring compliance with evolving regulations such as GDPR, FERPA, and state-level privacy laws. Boards and presidents should ask the same questions of data that they ask of investments: who manages it, what risks exist, and how are returns measured?

Governance is infrastructure for trust. It aligns ethical, legal, and operational responsibilities so the institution can both protect and unlock its information assets. Treating data stewardship as a fiduciary duty signals that information is a long-term strategic asset governed by the same discipline that built the financial endowment.

The Consolidation of Data Wealth

History shows that wealth consolidates in the hands of those who best understand its mechanics. Over the past 50 years, capital has concentrated among those who leveraged compounding returns. Warren Buffett’s wisdom that simply placing money in the S&P 500 yields enduring growth applies equally to data: consistent, disciplined stewardship beats sporadic, reactionary action.

The same consolidation is happening with data. The “wealthiest” data holders, major platforms and corporations, are not those who sell data, but those who understand its ecosystem. Like financial capital, data has begun to concentrate among the few who manage it effectively. Consumers, meanwhile, make choices about where to spend their “data capital.” They are far more likely to share information with trusted, value-creating entities.

This mirrors the marketplace: just as consumers may still frequent local shops for various reasons, the majority of their transactions occur where value is aggregated, at scale.

Ethics and Trust as the Foundation of Value

Just as financial capital depends on reputation, data capital depends on consent and integrity. Protecting privacy, documenting consent, and being transparent about data use are not constraints on innovation; they are preconditions for it. When constituents know their information is respected, they share more of it, and its quality improves.

In a world in which data functions as currency, individuals must choose to invest theirs with your institution. That choice, the act of opting in, signifies trust, engagement, and alignment with your institution’s mission.

Winning the Data War

The value exchange becomes critical: the student, graduate, or donor must see a return for their participation, whether that’s a more relevant experience, a personalized connection, a deeper sense of belonging, and of course making a difference. When data is offered freely, it comes with intent and authenticity, making it more accurate, more actionable, and more valuable over time.

Building a data endowment begins with infrastructure and a strong data foundation. Invest in the systems and architecture that allow data to be captured, connected, and consumed by machines as opposed to just storing it. Without this foundation, data remains fragmented, inert and incapable of generating the institutional intelligence that modern decision-making demands. Infrastructure is not a technical expense; it’s a strategic investment in the institution’s ability to think, predict, and adapt at scale.

The AI Multiplier

Algorithms are only as smart as the data upon which they’re trained; the value of AI doesn’t lie in the algorithm itself—it lies in the quality and completeness of the data ecosystem beneath it. Institutions that invest in disciplined data foundations will see AI accelerate everything from academic discovery and enrollment strategy to alumni engagement and philanthropic outcomes. Predictive models can identify which students are most at risk of attrition, which alumni are most likely to reengage, and which research partnerships hold the greatest promise.

From Metaphor to Action

The institutions already building their data endowment look less like tech startups and more like disciplined investors. They reinvest insights. A campaign report that identifies what inspired a major gift informs the next outreach. A retention model trained on student engagement data feeds real-time interventions. An institution begins to anticipate rather than react.

Reframing Relevance in Higher Education

There’s a narrative that universities have lost relevance by overproducing skillsets the market doesn’t demand. Maybe, there is certainly that argument. An effective counter argument is perhaps that the new demand is not in chasing the market but instead going back to the fundamentals of teaching a skillset that is not necessarily a hard skill: how to think and how to learn.

This is an effective undergrad and a universally applicable skill; the second step is chasing the market demand. Taking a step back as an institution to cultivate thinkers who can navigate change provides the fundamentals of critical thinking, which is arguably eroding due to the industrialization of education. Higher education is more than just a supplier of skills but should also be a steward of wisdom in the data age.

The parallels between money and data are striking: both compound, both consolidate, both reward stewardship. But while financial endowments sustain operations, data endowments will sustain relevance, and institutions that recognize data as a store of value will build the next great compounding engines of higher education.

Rachel Crosbie is vice president of strategy and operations for Fundmetric.

RELATED RESOURCES

FAQs

Accreditation

AGB Policy Alert

Executive Order on Accreditation Implications for Governing Boards

Blog Post

The Role of Trustees in Accreditation*