Opinions expressed in AGB blogs are those of the authors and not necessarily those of the institutions that employ them or of AGB.

Traditional stocks and bonds may be challenged in the near-term to produce returns consistent with their historical averages given current high valuations and probable rising interest rates. Therefore, many endowments are looking to alternatives, particularly private assets, in an effort to generate higher rates of returns to help meet their spending rates, mostly hovering around 5%. Despite the pandemic, endowments are susceptible to inflationary pressures that are high now from the shift in policy to fiscal dominance, and pre-recession trends like populism, nationalism, de-globalization and a sign that the US dollar may either lose or have to share its reserve currency status. Moreover, we see inflationary signals like the 6-year high in soft commodities, rising industrial metals and oil prices, rising manufacturing prices, and the S&P 500 / Gold ratio that is still more than 15% below its peak.

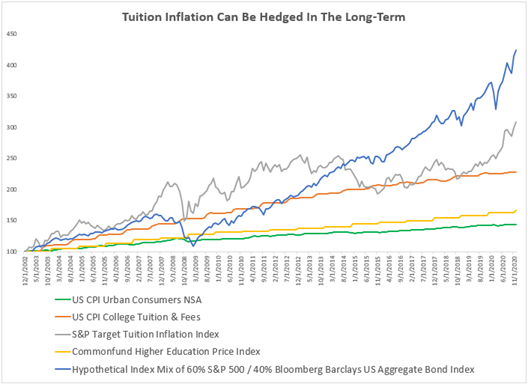

Endowments face a unique dilemma to keep pace not just with headline inflation, but ideally to offset tuition inflation. There is pressure on an endowment to perform well to help lower college costs for students, even if it is for expenses beyond tuition. While general college expenses increase in-line with headline inflation and include labor costs plus a number of other things that go into producing education, tuition inflation rises more than the headline CPI. Costs associated with college tuition and fees, as measured by the US Bureau of Labor Statistics, have outpaced general US inflation as measured by CPI (4.7% versus 2.0%, annualized from January 2003–December 2020). Note the Commonfund Higher Education Index that measures expenses including faculty salaries, administrative salaries, clerical, service employees, fringe benefits, miscellaneous services, supplies and materials, and utilities increased at an annualized rate of 2.8% (January 2003–December 2020,) slightly higher than the 2.0% measured by CPI.

Exhibit 1: Tuition Inflation Can Be Hedged In The Long-Term

The tuition inflation spread above general inflation can be explained by the typically inverse relationship between tuition increases and funding by appropriations and endowments that may be driven by investment performance. It’s possible, as shown by the S&P Target Tuition Inflation Index in Exhibit 1, for college tuition and fees inflation to be hedged over the long-term using a mix of short stocks, long corporate bonds, and cash – in addition to US Treasury Inflation-Protected Securities. The S&P Target Tuition Inflation Index annualized return from January 2003–December 2020 was 6.5% versus 8.3% for a hypothetical index of 60% S&P 500 / 40% Bloomberg Barclays US Aggregate Bond Index, though the S&P Target Tuition Inflation Index had less severe drawdowns through the global financial crisis and pandemic.

However, some endowments may not be able to take the risk needed for the required return in the short-term so may be forced to drawdown more than their stated spending rates. According to the 2019 NACUBO-TIAA Study of Endowments® (NTSE), the endowment size is critical in understanding risk, mainly from equity exposure. For example, NTSE reported endowments over $1B had 11.2% in US equities, while endowments with $25–50M had 37.8% and those with $25M or less had 45.7% in US equities. So while smaller endowments may be less likely to provide major sources of revenue, they are most exposed to the equity market volatility where private assets might help, but if the size is too small then hedging with liquid assets may help in a downturn.

On a dollar-weighted basis, NTSE stated 19.1% of assets were allocated to marketable alternatives on average but certain plans allocate far more. For large endowments with high risk tolerance and a goal of generating alpha, liquid bonds may not offer the right potential upside, or, even worse, present big downside risk from rapidly rising interest rates or a credit crisis. In lieu of bonds in the hypothetical 60/40 index, endowments may allocate to private assets. While the risk appetite is not high for all, it is not uncommon to see 40%–50% dedicated to alternatives, though certain risks need to be considered if direct investments are made in commodities where there’s physical inventory and transportation risk, or in real estate where unusable tax advantages may be wasted.

Especially now, when risk is high from stocks and bonds, it makes sense for appropriate investors to consider private assets for diversification, mitigating overall portfolio risk, income and needs. Specifically, private equity and private credit provide a potential premium to their public counterparts, but in the environment with strong inflationary pressure, private real assets, including commodities, real estate and infrastructure, are important for hedging inflation while hedged strategies may provide extra diversification. In allocating these private assets, leverage often drives risk and return characteristics, so mixing core and value-add/opportunistic assets can help clients reach their optimal portfolio commensurate with their risk profile.

References and Resources

Disclosures

The sole purpose of this material is to inform, and it in no way is intended to be an offer or solicitation to purchase or sell any security, other investment or service, or to attract any funds or deposits. Investments mentioned may not be appropriate for all clients. Before making any investment, each investor should carefully consider the risks associated with the investment, as discussed in the applicable offering memorandum, and make a determination based upon their own particular circumstances, that the investment is consistent with their investment objectives and risk tolerance. Equity securities may fluctuate in response to news on companies, industries, market conditions and general economic environment. Companies paying dividends can reduce or stop payouts at any time.

Fixed Income investing entails credit risks and interest rate risks. When interest rates rise, bond prices generally fall.

Alternative investments often are speculative and include a high degree of risk. Investors could lose all or a substantial amount of their investment. Alternative investments are appropriate only for eligible, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time. They may be highly illiquid and can engage in leverage and other speculative practices that may increase the volatility and risk of loss. Alternative Investments typically have higher fees than traditional investments. Investors should carefully review and consider potential risks before investing.

The views and opinions expressed in this material are those of the author, Jodie Gunzberg and other Morgan Stanley sources referenced, as of the date noted and do not necessarily represent those of Morgan Stanley Smith Barney LLC, its affiliates or its other employees. Of course, these views may change without notice in response to changing circumstances and market conditions. Certain information contained herein may constitute forward-looking statements. Due to various risks and uncertainties, actual events, results or the performance of a fund may differ materially from those reflected or contemplated in such forward-looking statements.

Indices are unmanaged and investors cannot directly invest in them. They are not subject to expenses or fees and are often comprised of securities and other investment instruments the liquidity of which is not restricted.

Past performance is no guarantee of future results. Actual results may vary. Diversification does not assure a profit or protect against loss in a declining market.

© 2021 Morgan Stanley Smith Barney LLC, Member SIPC. Alternative investment securities discussed herein are not covered by the protections provided by the Securities Investor Protection Corporation, unless such securities are registered under the Securities Act of 1933, as amended, and are held in a Morgan Stanley Wealth Management Individual Retirement Account. Graystone Consulting is a business of Morgan Stanley.

CRC3406382 01/21

With Thanks to AGB Sponsor: Graystone Consulting

Franco Lofaro

Executive Director, Head of Business Development

Graystone Consulting

Franco.Lofaro@msgraystone.com

Jodie Gunzberg is the managing director and chief investment strategist for Graystone Consulting of Morgan Stanley.