Opinions expressed in AGB blogs are those of the authors and not necessarily those of the institutions that employ them or of AGB.

The question of “how to best address the increased uncertainties we face” has marked our recent conversations with higher education leaders at colleges, universities, and institutionally related foundations. The higher education sector continues to confront challenges that have created institutional uncertainties, from declining enrollments to greater tuition discounting to more rapid leadership turnover, to name a few. Worries over demographic trends and possible policy changes from the new administration are amplifying concerns.

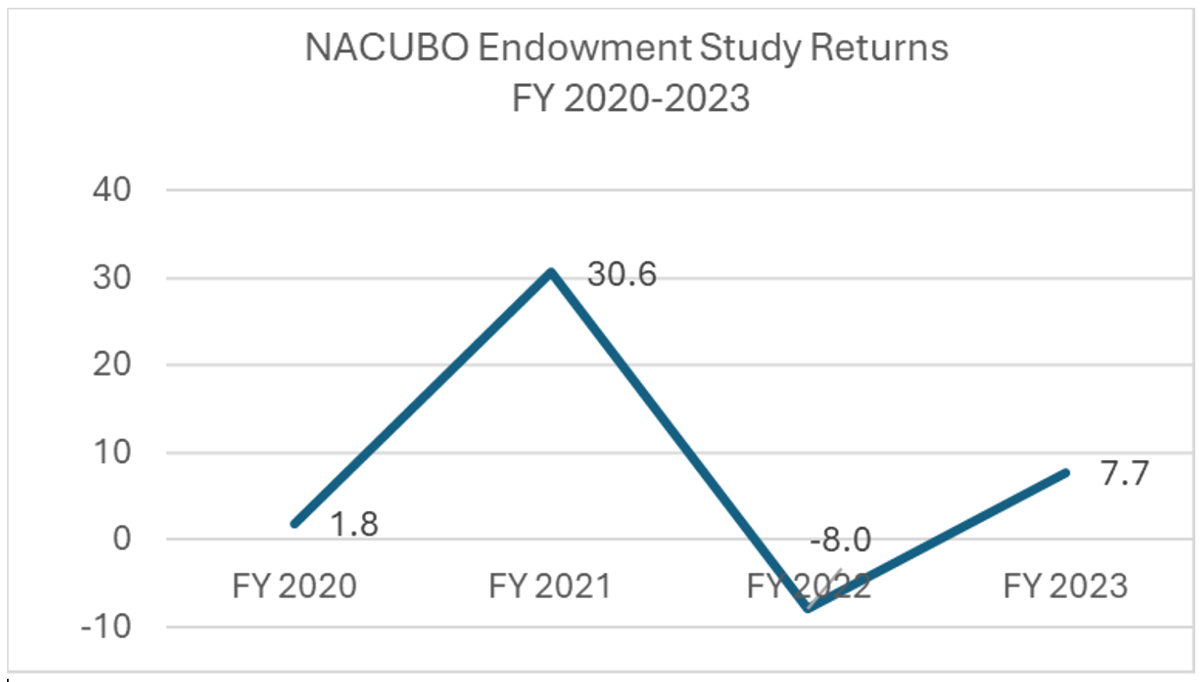

Additionally, many higher education financial leaders fear a continuation of heightened volatility for their endowment returns, akin to what they experienced after the start of the pandemic. The chart below reflects the investment returns for all endowments reported in the annual NACUBO-Commonfund Study of Endowments and the wide swings in annual investment returns related to changes in economic growth, inflation, interest rate volatility, and volatility in private and public market equity returns.

The average change in annual returns during this period was 27.7 percent per year. While the NACUBO endowment study returns for FY 2024 had not been released at the time of this writing, they are expected to be positive and modestly higher than those of FY 2023, making for a decline in volatility from the prior four years. Indeed, equity market volatility in 2024, as measured by the VIX index, has declined to pre-pandemic levels. As a basis for projecting FY 2024 returns, the Wilshire Trust Universe Comparison Service universe of endowments and foundations posted an average return of 11.7 percent for the one-year period ended June 30, 2024.

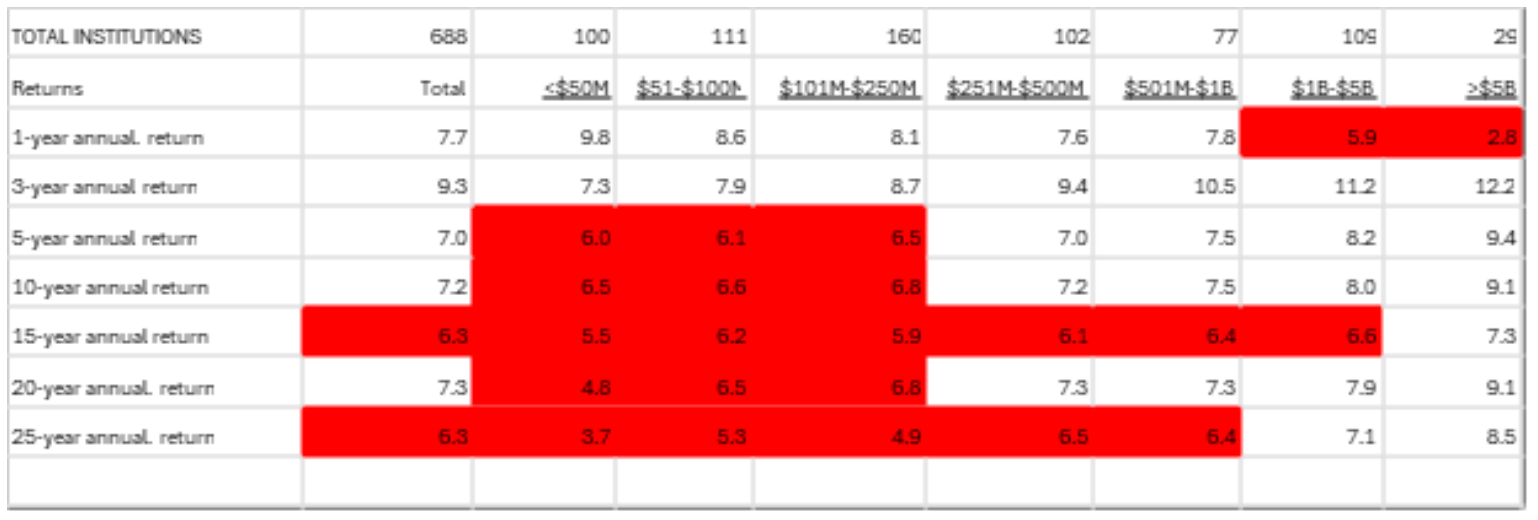

Moreover, many higher education leaders are concerned about the level of expected future returns for their endowments. After all, many colleges and universities have a hurdle rate of around 7 percent, with average spending rates near 4.5 percent and inflation expectations of about 2.5 percent (based on historic NACUBO endowment studies and Mercer estimates). It has already been difficult for many to consistently achieve the hurdle rate, even over the long term, as shown in the table below.

What is the outlook for achieving the necessary returns going forward? As we consider and decompose portfolio asset class potential returns broadly, we recognize the uncertainty in near-term returns. While marketable equities (particularly in the United States) have delivered strong returns following a major drawdown in 2022, valuation levels are increasingly elevated relative to historic norms. On the private markets side, private equity and venture capital market returns have moderated considerably relative to those of public equities and from the outsize returns earned in FY 2021. Private equity and venture capital returns in 2021 triggered short-term overinvestment, which, combined with higher interest rates, led to more moderate subsequent performance. Private real estate has been challenged in many sectors since the pandemic, given work-from-home and online shopping preferences, along with higher interest rates. Also, after a severe drawdown in FY 2022, fixed-income returns have generally been muted but positive. While returns over the short term may not consistently meet endowment hurdle rates, Mercer projections for diversified endowment portfolios, which include both public and private market assets, suggest that they are likely to achieve or surpass the 7 percent threshold over time.

Future economic conditions and inflation rate changes remain unclear, given public policy uncertainty. Policy uncertainty may amplify market volatility for endowments.

Indeed, policy uncertainty has clearly heightened concerns for higher education institutions more broadly. For large endowments, the Tax Cuts and Jobs Act (TCJA) of 2017, which includes many provisions that expire at the end of calendar year 2025, imposed a 1.4 percent endowment tax on the largest and wealthiest private institutions (those that have at least $500,000 in endowment per student and over 500 students). As a result of Donald Trump’s reelection, Congress is likely to renew the TCJA, and it has already introduced bills that would increase both the number of endowments taxed and the magnitude of the tax.

In addition, some leaders express uncertainty about future donations to support endowment growth as well as operating and capital needs. While gifts are generally positively correlated with equity market returns, reflecting the tax benefits associated with giving appreciated securities, other factors play a major role in donor intent. These include the connection that alumni feel to the institution and its mission. Some leaders worry these ties may have been eroded by recent campus politicization. They express concerns that any tax policy changes or other legislative updates (e.g., potential changes to donor-advised fund distribution requirements) may provide additional uncertainties around gifts. Many institutional fundraising professionals recognize the need to work harder and more creatively to drive giving and create a deeper bond to campus, reminding potential donors of the significant benefits their higher education institutions provide to students and to society.

There is no single or simple solution for higher education leaders to apply for best managing their institutions and associated financial resources through the current economic, investment, and policy uncertainties. That said, capital market returns will be what they will be, but adhering to sound investment policies is the best way to attain the investment results needed for your institution.

These policies begin with a thorough and up-to-date investment policy statement (IPS). The IPS should allow for broad diversification among asset classes that aren’t highly correlated with one another. The investment portfolio should have an equity tilt to achieve long-term growth but should also include diversifying assets such as fixed income and hedge funds. To the extent that your institution has the capacity to tolerate illiquidity and can gain access to superior managers, investing in illiquid private market alternatives could potentially benefit future returns. Likewise, a spending policy that is structured to meet your institution’s needs and that mitigates volatility is a critical element for success. After all, most institutional endowments are likely to be perpetual, so it is the spending volatility that has an impact on annual operations.

In addition to spending policy, taking an endowment’s spending distribution through the year, rather than on a single day, mitigates the risk of liquidating the endowment at an inopportune time in the market. A rebalancing policy that enables your institution to take advantage of short-term portfolio volatility (such as we witnessed at the start of the pandemic) and to rebalance from overallocated assets to underweighted ones allows the endowment to take advantage of market volatility. Investment returns are never achieved without taking on some risk. That said, your asset allocation, spending policy, and rebalancing policy remain critical tools to help your institution navigate through market volatility.

Lucy Momjian, CFA, CAIA is senior education strategist at Mercer

Important Notices

References to Mercer shall be construed to include Mercer (US) LLC and/or its associated companies.

© 2025 Mercer (US) LLC. All rights reserved.

This content may not be modified, sold, or otherwise provided, in whole or in part, to any other person or entity without Mercer’s prior written permission.

Mercer does not provide tax or legal advice. You should contact your tax advisor, accountant, and/or attorney before making any decisions with tax or legal implications.

This does not constitute an offer to purchase or sell any securities.

The findings, ratings and/or opinions expressed herein are the intellectual property of Mercer and are subject to change without notice. They are not intended to convey any guarantees as to the future performance of the investment products, asset classes or capital markets discussed.

For Mercer’s conflict of interest disclosures, contact your Mercer representative or see mercer.com/footer/conflicts-of-interest-mercer-investments.

This does not contain investment advice relating to your particular circumstances. No investment decision should be made based on this information without first obtaining appropriate professional advice and considering your circumstances. Mercer provides recommendations based on the particular client’s circumstances, investment objectives and needs. As such, investment results will vary and actual results may differ materially.

With Thanks to AGB Sponsor: Mercer

![]()

RELATED RESOURCES

Reports and Statements

Collaborative Leadership for Higher Education Business Model Vitality