The late David Swensen, famous for his role as chief investment officer of the Yale University endowment from 1985 through 2021, remains one of the most highly regarded figures in the higher education endowment world due to his pioneering approach to investment management that is employed by hundreds of institutions today. Yet Mr. Swenson does not receive nearly as much recognition for his work on spending policy. The opening quote, from Swensen’s timeless book, Pioneering Portfolio Management, reminds us that the spending policy is an important strategic decision that has profound implications for how risk, or volatility, is ported from the investment portfolio to the institution’s operating budget.

After extensive research as well as practical experience with Commonfund institutional clients, we share three primary conclusions that merit thoughtful consideration from those responsible for college and university endowments.

CONCLUSION 1

Spending policy is the most overlooked aspect of endowment management, and many institutions are likely not employing the optimal calculation.

Many investment committees review asset allocation annually but neglect another key aspect of strategic policy: spending. As the only permanent link between the endowment and the institution it supports, the spending, or distribution, policy is a critical component of endowment management and should be revisited just as frequently as asset allocation. More specifically, the investment committee should ensure that the endowment has adopted the optimal calculation for its institution by considering the operating budget’s reliance on the endowment and sensitivity to distribution volatility.

Whether due to its simplicity in calculation and/or its ability to be easily explained to donors, most institutions have defaulted to using the rolling average spending method. According to the 2021 NACUBO-TIAA Study of Endowments, 74 percent of responding higher education institutions used the moving average methodology. Given the favorable capital market and philanthropic conditions of the past decade, the moving average formula has performed well. As we have experienced in the first eight months of 2022, however, it is likely that conditions will not be as idyllic. Therefore, the time is now to explore whether your endowment is using an optimal spending calculation.

We have developed a set of questions that can help guide a committee—and staff—toward selecting the most appropriate spending policy. For many, an optimal spending policy is one that offers some combination of the following:

- Provides a consistent, and growing, level of annual support in most years (that is, a policy that minimizes reductions in spending).

- Offers a sufficient amount of long-term, total support of the operating budget while leaving enough capital in the endowment to compound for future generations.

- Allows the endowment to prudently take as much risk as needed to meet its long- term return objective while limiting the transfer of that risk to the institution.

- Allows an investment committee to stick with its long-term allocation plan, especially during periods of sizable market drawdowns.

CONCLUSION 2

For many, the most pertinent risk related to the endowment is not portfolio volatility, or even drawdown, but spending volatility and/or drawdown.

Historically, portfolio risk has been defined as volatility or standard deviation. But the more relevant risk for an endowment is periods of drawdown relative to a real return objective and the length of time it takes to recover the loss. Where the rubber meets the road for most higher education institutions is not a drawdown of the endowment pool but rather a drawdown of the distribution used to support the institution. The latter is what directly leads to budgetary shortfalls and potentially difficult financial decisions.

Which metrics are preferable for measuring spending risk or drawdown? And how does one go about calculating those risks? There are three key metrics that we use with our clients to evaluate these risk factors:

Spending Volatility

The standard deviation (or dispersion relative to the mean) of the annual spend.

Reasonable goal: ensure this metric is lower than the investment volatility of the portfolio, which would mean that the spending formula is effectively mitigating the volatility generated by taking risk in the endowment.

Negative Spend

A calculation of the percentage of years in which spending in dollars for year x is less than spending in dollars for year x-1 (that is, spending in dollars declines year over year).

Reasonable goal: limit the number of negative spending years to maintain consistent and growing support from the endowment.

Annual Spending Drawdown

The average and maximum percentage of decline in spend dollars, year over year, during these negative spending years.

Reasonable goal: minimize the annual spending drawdown to avoid sizable budget shortfalls that could cause operational stress for the institution.

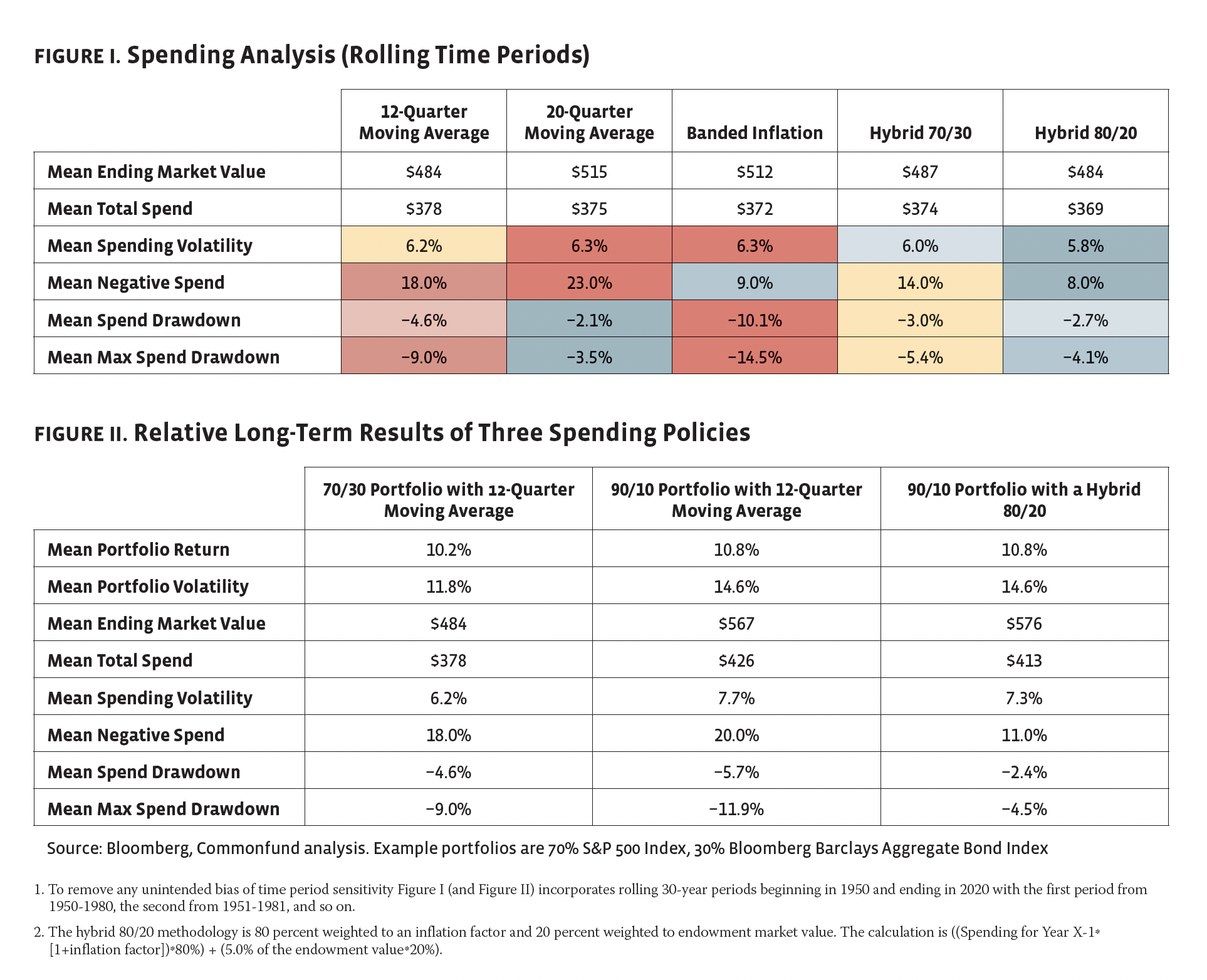

Focusing on mitigating these key risk statistics calls into question the validity of the rolling average spending method referred to earlier. Why? Because using this methodology leads to more periods of drawdown and the time to recover is longer compared to other methods. Figure 11 shows this in comparison. Over an extended period, the spending method that proves most favorable from a spending risk perspective is the hybrid 80/20 policy,2 as it has the fewest negative spend years and the second-lowest average annual negative spend decline. This methodology provides a consistent and stable stream of support to the institution.

We find that most colleges and universities are challenged by a high percentage of negative spend years. So why haven’t more institutions chosen to adopt a hybrid policy? The primary reasons were cited earlier: more challenging to calculate and explain to donors. In our view, these do not justify employing a spending policy that may result in suboptimal support and/or an investment policy that cannot take on the level of risk needed to reach long-term goals.

CONCLUSION 3

Spending policy not only should influence strategic asset allocation but also should be thought of as the other “free lunch” of long-term endowment investing alongside diversification.

In 1952, Nobel Prize laureate Harry Markowitz famously said, “Diversification is the only free lunch in investing.” While the benefits of portfolio diversification still apply today, they are perhaps not as powerful owing to an overall rise in correlations between asset classes. Moreover, educational institutions may need to rely more heavily on their endowments going forward to help offset the negative impact from enrollment pressures. That likely means adopting an allocation plan that targets more risk in order to generate higher long-term returns. But if portfolio diversification does not offer the same risk mitigation characteristics we have experienced historically, where can we find additional downside protection? We believe it is through the spending policy.

A primary option to help an endowment increase the probability of meeting its long-term objective is a higher allocation to growth assets (that is, the amount in equity-like investments relative to fixed income-like investments). Yet this raises a concern: the potential volatility associated with such a portfolio. While in the long run, there is a high correlation between the allocation to growth assets and the probability of achieving intergenerational equity, the shorter-term path and potential for market downturns must also be considered.

While this is important, selecting an investment plan based solely on maximizing return per unit of risk while ignoring the spending policy’s ability to mitigate some of that investment risk is an oversight we see all too often. We would argue that if a spending policy that decouples spending from the endowment market value is implemented, it may allow the portfolio the opportunity to increase its allocation to growth assets without the commensurate increase in the risk that matters most, the distribution.

In pursuit of an answer, we modeled two allocations, as shown in figure II: (1) a traditional 70 percent equities/30 percent fixed income allocation and (2) a 90/10 allocation, both using the 12-quarter moving average (given it is the most widely used spending methodology). We then modeled a hybrid policy with the 90 percent equities/10 percent fixed income allocation to determine whether this spending formula could help mitigate the increased level of investment risk.

Modeling 30-year rolling periods from 1950-2020, unsurprisingly, the portfolio with the higher allocation to equities fares better from a return perspective in all 42 of the periods modeled. However, that increase in equity risk results in a similar increase in volatility and portfolio drawdowns. Thus, we might conclude that increasing our allocation to risk assets is not worth the potential pain. Just because a portfolio is experiencing volatility or undergoing a drawdown period does not necessarily mean that endowment support to the institution will experience a similar drawdown.

As can be seen in Figure II, the 90/10 portfolio that employs a hybrid policy continues to offer favorable spending risk statistics despite the higher equity allocation. Both negative spend and annual spending drawdown are lower and portfolio volatility increases only modestly by shifting to 90 percent equities. We would argue that for most institutions this slight increase in spending volatility is likely worth the added benefit of higher projected returns, endowment market value, and, most importantly, support for the institution.

Conclusion

We recommend that investment committees devote more time to endowment spending policy and recognize it for what it is: a vital tool that should be sufficiently considered when designing strategic policy that positions institutions of higher education for intergenerational success. We believe these three core conclusions and accompanying guidance will help readers bring a more comprehensive approach to endowment management to their organizations.

Anthony Peretore, CFA and CAIA, is the Managing Director at Commonfund Asset Management.

Rachel Clivaz is an Associate Director at Commonfund Asset Management.

For more in-depth discussion and analysis please download the full white paper: https://info.commonfund.org/endowment-spending-policy