Opinions expressed in AGB blogs are those of the authors and not necessarily those of the institutions that employ them or of AGB.

University endowments are taking sustainable investing seriously, allocating $378 billion to sustainable investing strategies in 2020 (up 19 percent from 2018)[1]. This investment philosophy resonates well with students, faculty, and broader stakeholders, and aligns with the mission of higher education in preparing students for long-term value creation. For endowments looking to get started—or to expand upon their sustainable practices—here are three ideas to consider.

#1 Look for multidimensional commitments to Diversity

According to the American Council on Education, college student populations are diversifying. Students are looking for their universities to reflect diversity through faculty and staff, programming, and expressed in their investment practices as well. We have noticed a trend of endowments incorporating diversity goals into selection for investment portfolios as well as investing with managers that represent a commitment to diversity, equity, and inclusion (DEI). This commitment can be expressed in portfolio construction, a thoughtful approach to investment stewardship, and/or in the staffing of the investment manager directly.

We work with endowments for whom we integrate diversity metrics into managing the due diligence process, in the investment decision-making, and in stewardship. Increasingly, we observe investors evaluating diversity across the value chain, and turning that due diligence lens onto our practice, considering the ways that we demonstrate our commitment to DEI through a variety of mechanisms, including brokerage, stewardship portfolio construction, and our own staffing. This trend is ramping up, and we anticipate the focus here to be long-lasting.

#2 Respond to Climate Change

From an investment perspective, climate change poses a great threat that could negatively impact economic growth, inflation, and investment returns. Endowments are responding to this risk in multidimensional ways by integrating climate risk metrics into their portfolio management. In 2020, educational institutions ranked climate change and carbon emissions as their top criteria amongst all ESG issues, integrated into the management of $233 billion in assets, a 63 percent increase from 2018.

Stewardship activities, such as proxy voting and engagement with portfolio companies, allow endowments to voice climate risk concerns. The goal of these actions is to encourage companies to improve their reporting framework on climate risks, offering more transparency and disclosure and even reduce their carbon footprint by setting greenhouse gas reduction targets.

For example, Climate Action 100+, a collaborative engagement initiative, allows investors to increase the weight of their voice, exerting further pressure on companies to respond. This initiative, which launched in 2017, has indeed demonstrated initial success.

# 3 Integrating ESG into your Investment Philosophy

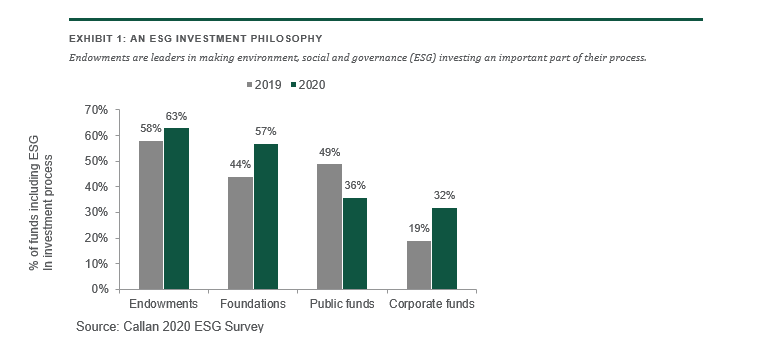

A growing number of endowments are including environmental, social, and governance (ESG) analytics into their investment philosophies more broadly, as evidenced by more than 25 signatories of the Principles for Responsible Investing[2] associated with North American universities. According to Callan’s annual ESG survey (see Exhibit 1), nearly two-thirds of endowment respondents reported incorporating ESG into the investment process, leading all other respondent types. Investors are gaining confidence that sustainable investing strategies can perform in-line with market return expectations—an assessment that was bolstered by the robust performance of the majority of ESG labeled funds during the market volatility during the first quarter of 2020. According to a study done by Morningstar, 70 percent of sustainable equity funds ranked in the top halves of their categories and 44 percent ranked in the best-performing quartile in their peer groups. Additionally, our research showed how ESG outperformance was seen across asset classes.

Getting Started

There are many entry points for endowments to include sustainable investing in their portfolios. Here are a few ideas to consider:

- Start with a consensus on investment objectives that include sustainable investing attributes and risk/return profile.

- Review how your managers are voting proxies on your behalf.

- Decide how to add or increase sustainable investing into your portfolios. Some endowments begin with distinct pools of funds as a first step, such as student-run portfolios. Others test out sustainable investing in one asset class and move it into other asset classes as appropriate.

- Look for resources. Industry bodies such as the Principles for Responsible Investing, the National Association of College and University Business Officers (NACUBO), and the Association of Governing Boards of Universities and Colleges provide materials such as webinars, panel discussions or written materials to support education. Asset managers and OCIO providers often produce resource materials. We publish relevant materials on our website and our blog.

We are encouraged that endowments are engaging in productive discussions, an important step to put more endowments on the path to a holistic investment philosophy that is aligned with long-term sustainable value creation.

[1] 2020 Sustainable Investing Trends Report, US SIF

[2] PRI signatory database

Emily Lawrence is director of sustainable investing for the Institutional Client Group of Northern Trust Asset Management.

Sharee Zlatkova is an investment associate of sustainable investing for the Institutional Client Group of Northern Trust Asset Management.

References and Resources

- Learn more about sustainable investing and our sustainable investing team at Northern Trust Asset Management.For more information on our approach to assessing DEI please see The Holistic Way to Invest in Diversity.For more insights, visit pointofview.northertrust.com

With Thanks to AGB Sustaining Sponsor: Northern Trust

Emily Lawrence

Director, Sustainable Investing

Institutional Client Group

Northern Trust Asset Management

Northern Trust

EL84@ntrs.com

Sharee Zlatkova

Investment Associate, Sustaining Investing

Institutional Client Group

Northern Trust Asset Management

Northern Trust