AGB’s Council of Finance Committee Chairs held its second meeting virtually in October 2021. Below are the takeaways from this event.

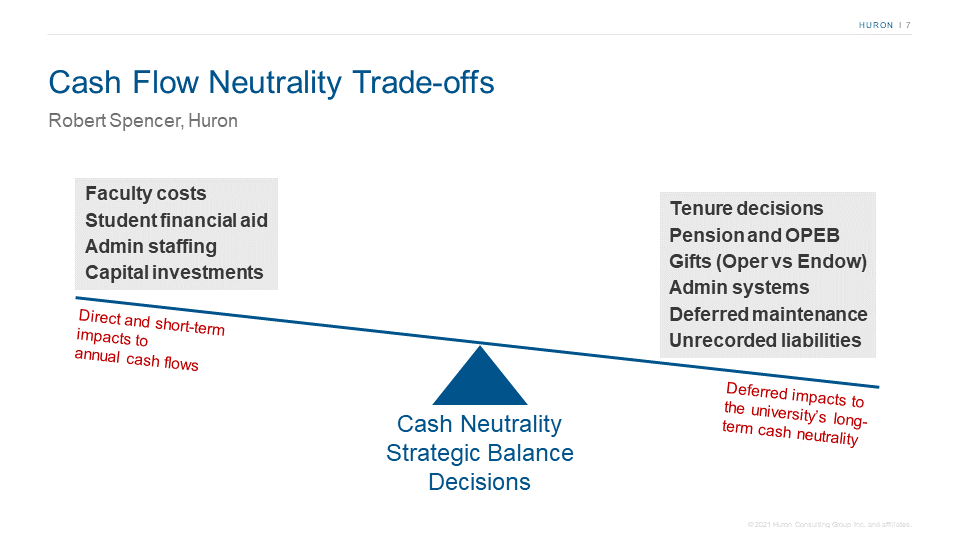

The Council of Finance Committee Chairs, building on its inaugural July 2021 discussion of institutional finance issues boards must consider as part of their fiduciary duties, in October 2021 examined the problem of how to quantify and capture unrecorded liabilities (e.g., deferred maintenance) that institutions incur over time. Quantifying and capturing these liabilities allows boards to evaluate the full measure of their decisions on institutional finances both in the short and long term, as illustrated below by a figure prepared for the meeting.

The core discussion involved creating a business model that captured and quantified “cash neutrality,” defined as an institution’s actual current operating revenues being in excess of actual cash outflows for its budget obligations. Further, the institution’s projected revenues would be reasonably expected to be at least equal to its cash outflows on an ongoing basis.

The discussion made clear no single model could accommodate all institutions’ needs. However, participants identified a number of common long-term cost impacts that such a model could aid in capturing and quantifying for discussion:

- The “black box” of current and future compliance costs, particularly at campuses with large research enterprises and/or health care systems;

- Climate change, both as an aspect of deferred maintenance and as an immediate concern for campuses large and small;

- Deferred maintenance (brought up by multiple participants as an issue both for existing buildings and new buildings, particularly in the case of very old and/or historic buildings that lend great charm to a campus but are difficult and expensive to maintain);

- “The deferred maintenance of human capital,” as one participant termed it (i.e., recognizing that personnel costs often stretch over decades of institutional life, not just a single budget year or balance sheet);

- Technology systems (e.g., business systems, online learning platforms, and so forth).

Another discussion topic informed by these cost impacts was the idea of a comprehensive campus space strategy. As one participant commented, where and how many people work—both in businesses and on campuses—has been “fundamentally changed” by the upheavals of the COVID-19 pandemic. (The virtual Council meeting aptly illustrated that point.) Thus boards will need to consider the best and most financially prudent use of their campuses’ physical space, including how deferred maintenance costs will affect that space, to accommodate both current and future generations of learners and workers.

The meeting emphasized the important role of finance committee chairs in helping the board carry out its fiduciary duty. It also illuminated the complex problems with which boards must grapple as long-term costs come due on multiple fronts.

With thanks to AGB Sustaining Partner Huron Consulting Group for their support of this council.