Opinions expressed in AGB blogs are those of the authors and not necessarily those of the institutions that employ them or of AGB.

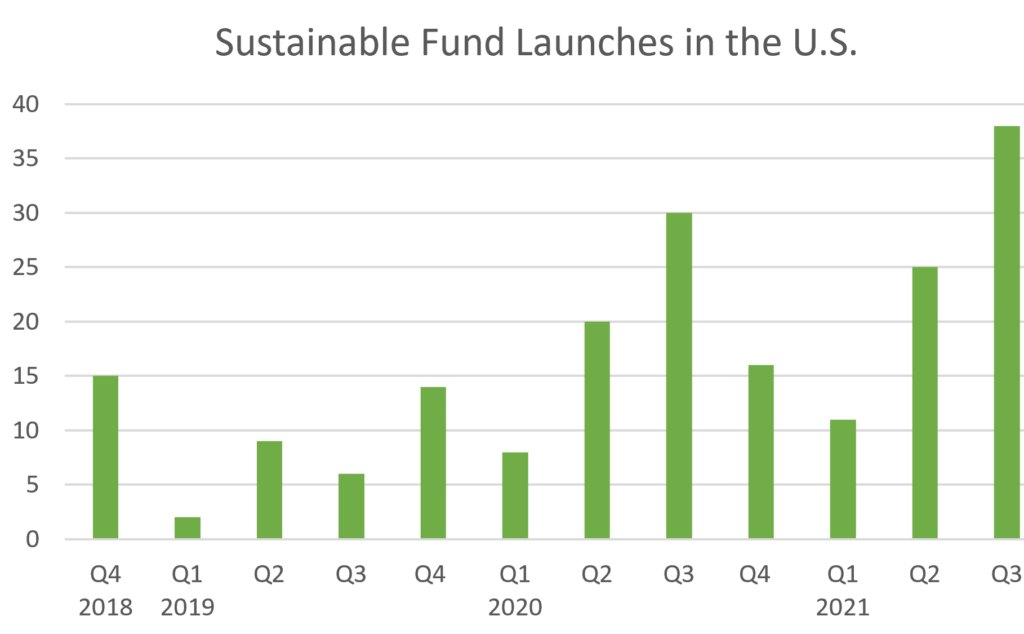

Across North America, university endowments are increasingly reviewing how to integrate sustainability objectives into their portfolio management. According to the U.S. Sustainable and Impact Investing Forum (US SIF), American educational institutions reported $378 billion in assets that were subject to environmental, social, and governance (ESG) criteria in 2020, an increase of 19 percent from 2018.1 In response to the heightened demand, asset managers have been quick to bring sustainable investment products to the marketplace, either through launching new vehicles or repurposing current funds to integrate ESG data and analytics. In the third quarter of 2021, alone, a record 38 funds with sustainable investing objectives were launched in the US2. The good news is that a growing suite of cost-effective pooled vehicles, as illustrated in the chart below, makes allocating to sustainable strategies more accessible, but the challenge lies in the need for additional due diligence. Varying definitions, different types and processes for integrating ESG data, and a lack of standardization on reporting and transparency makes it challenging to compare apples to apples across strategies. It also opens the door for confusion on the degree and depth of ESG incorporation in an investment strategy.

Source: Morningstar Direct, Morningstar Research. Data as of Sept 20213

This isn’t a problem unique to the United States. With the prominent belief that European investors are further along in the process of incorporating ESG into their investment approach, it would be reasonable to assume that clear and consistent communication on ESG characteristics would be the standard. However, many asset managers with whom the Northern Trust Multi-Manager Investment (MMI) team met in the last several years highlighted greenwashing as a primary issue for investors in Europe. To combat this issue, the European Commission implemented the Sustainable Finance Disclosure Regulation (SFDR), which imposes mandatory ESG disclosures for asset managers with fund structures domiciled under their purview. Asset managers are required to classify each of their funds based on a set of standard ESG definitions, with the goal of providing the investor with accurate comparisons across the investment universe.

The momentum of regulation overseas, coupled with a change in administration domestically, has led to anticipated regulation in the United States. In March 2021, the Securities and Exchange Commission created a Climate and ESG Task Force that initially has been focused on identifying material gaps or misstatements in asset managers’ disclosures. These events have resulted in asset managers placing a higher degree of scrutiny on their disclosures.

Given the lack of standardization and nascent regulation, how can an endowment select a strategy that aligns with its sustainability objectives, and how does it report its progress to its stakeholders? How can an endowment feel confident it is selecting a strategy that is demonstrating a clear commitment to sustainability rather than one that is sustainable in name only?

It is imperative that investors conduct due diligence to select strategies that are substantive. The Northern Trust MMI team conducts a comprehensive assessment of each approved or prospective strategy. The assessment covers four main pillars that together provide a multidimensional view of a sustainable strategy: a firm’s organizational commitment to sustainable investing, its sustainable investment process, its engagement policies, and its reporting capabilities. The MMI team is able to score and rank each strategy based on a set of criteria it believes to be most important when assessing the sustainable investment capabilities of an investment manager and provides clients with a set of expectations for strategies in their portfolios. Asset managers who exhibit executive level buy-in, integrate ESG data and analytics into their valuation models, are thoughtful stewards, and report on their ESG characteristics and initiatives, in general, will score higher in the framework.

As endowments seek to allocate to sustainable strategies, a principles-based approach to manager due diligence will support them in selecting strategies that meet their sustainability criteria but will also serve them in communicating consistently with their stakeholders. With a growing suite of options, the number of choices can be overwhelming. Starting with a clear perspective will help guide the endowment in the process, allowing it to articulate its goals to stakeholders such as students, faculty, and staff, as well as to service providers such as investment managers, outsourced chief investment officer (OCIO) providers, and others. Codifying these expectations will also support deeper dialogues with these service providers.

IMPORTANT INFORMATION. For Use with Institutional Investors Only. Not For Retail Use. For Asia-Pacific markets, this information is directed to institutional, professional, and wholesale clients or investors only and should not be relied upon by retail clients or investors. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Northern Trust and its affiliates may have positions in and may effect transactions in the markets, contracts, and related investments different than described in this information. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice, and does not take into account all the circumstances of each investor. Opinions and forecasts discussed are those of the author, do not necessarily reflect the views of Northern Trust, and are subject to change without notice.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation, or recommendation with respect to any transaction and should not be treated as legal advice, investment advice, or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. Information is subject to change based on market or other conditions.

Forward-looking statements and assumptions are Northern Trust’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

Past performance is no guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by Northern Trust. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs, or expenses. It is not possible to invest directly in any index. Net performance returns are reduced by investment management fees and other expenses relating to the management of the account. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. For additional information on fees, please refer to Part 2a of the Form ADV or consult a Northern Trust representative.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Belvedere Advisors LLC, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

© 2022 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.

Steve Indiveri is an investment analyst, multi-manager investments at Northern Trust Asset Management, an AGB sponsor

Emily Lawrence is the North American director of sustainable investing client engagement at Northern Trust Asset Management, an AGB sponsor

Northern Trust References and Resources

- Learn more about sustainable investing and our sustainable investing team at Northern Trust Asset Management.

- PAPER: Sustainable Investing Philosophy

- REPORT: Capital Market Assumptions – Five-Year Outlook (2022 Edition)

- SERVICES: Sustainable Investing Services

With Thanks to AGB Sponsor: Northern Trust

Steve Indiveri

Investment Analyst, Multi-Manager Investments

Emily Lawrence

North American Director of Sustainable Investing Client Engagement

RELATED RESOURCES

Trusteeship Magazine Article

Harmonizing Strategic and Academic Planning in Higher Education