Opinions expressed in AGB blogs are those of the authors and not necessarily those of the institutions that employ them or of AGB.

An understanding of your endowment or foundation’s ability to take risk will help you determine the most appropriate strategic asset allocation. In fact, setting the strategic asset allocation is the single most important decision your Investment Committee will make, far more important than the managers you select or the securities they purchase.

In general, the optimal strategic asset allocation will depend on several factors.

So how do you determine if your endowment or foundation has a high, moderate or low ability to take risk? The following framework can help determine your organization’s risk tolerance.

Examining Risk Tolerance from an Enterprise Perspective

Your risk tolerance will depend on your organization’s ability to manage spending and the importance of the asset pool’s contribution to operations. While numerous metrics exist to evaluate enterprise risk, we have found the areas below to provide a comprehensive, yet manageable, list for evaluation.

- Spending flexibility: if your spending methodology, spending policy and operating environment do not afford you the ability to lower spending in down markets, you have a lower ability to take risk

- Operational dependence: if your operational budget relies heavily on your endowment or foundation, you have a lower ability to take risk

- Operational reserves: if you do not have excess operational reserves to help cushion a down market, you have a lower ability to take risk

- Fixed vs. variable costs: if your cost structure is mostly fixed with few variable cost components, you have a lower ability to take risk

- Liquidity: if you have limited operational cash on hand and / or a significant percentage of your portfolio invested in illiquid investments, you have a lower ability to take risk

- Access to capital: if you do not have access to credit that you can rely on in down markets, you have a lower ability to take risk

- Debt / liabilities: the higher your relative debt and debt service levels, the lower your ability to take risk

Illustration of Assessing Risk Tolerance

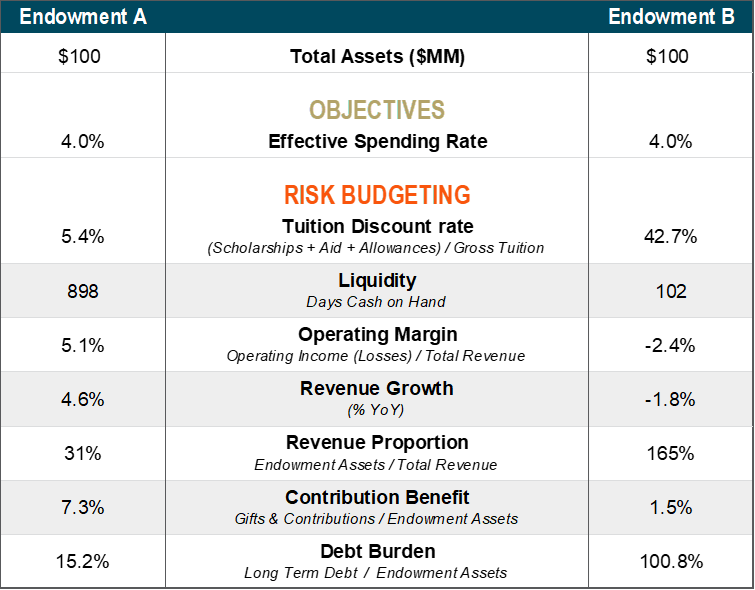

Let’s look below at a hypothetical illustration using two college endowments to help determine their ability to take risk.

Based on the metrics outlined above to evaluate enterprise risk, College Endowment A has a higher ability to take risk when compared to College Endowment B. College Endowment A appears to have a more resilient revenue stream with a significantly lower tuition discount rate, modest annual revenue growth and a robust donor base. College Endowment A is also less reliant on annual spending from the endowment, has greater spending flexibility thanks to their cash on hand and a stronger operating budget. Finally, College Endowment A has less financial leverage and a greater capacity to take on additional debt.

Risk Assessment Tools

BNY Mellon has developed a series of peer group reports to help organizations evaluate their ability to take risk from an enterprise perspective. The reports include an evaluation of the above metrics in isolation, as well as a comparison versus peers of similar type, asset size and/or geographical location. If you feel you would benefit from an enterprise risk / peer group assessment to help evaluate the ability of your enterprise to take risk, please reach out to Brian Worgan at Brian.Worgan@bnymellon.com.

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation. Trademarks and logos belong to their respective owners. BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation. ©2021 The Bank of New York Mellon Corporation. All rights reserved.

Brian Worgan is the senior director and client strategist for BNY Mellon Wealth Management.

References and Resources

- 2021 10-Year Capital Market Assumptions

- 2021 Outlook: Brighter Days Ahead

- BNY Mellon Wealth Management Webcast Series

- BNY Mellon Investor Solutions

With Thanks to AGB sponsor: BNY Mellon

Brian Worgan, AIF®, CSRIC™

Senior Director/Client Strategist

BNY Mellon Wealth Management

Brian.Worgan@bnymellon.com