Opinions expressed in AGB blogs are those of the authors and not necessarily those of the institutions that employ them or of AGB.

Most boards understand the crucial role that private capital plays in an institution’s investment portfolio. Many are also considering increasing allocations to illiquid assets to try to boost returns and capture more of the illiquidity premium. With everyone attempting to reach the same goal and coming to the same conclusions, now—more than ever—an intelligent private capital investment framework will be key to meeting your investment goals for the next 10 years.

What Should I Look for in a Partner?

College and university investment committees frequently utilize outside investment expertise to help them build their private capital programs. While the focus is often on the important question of how much to invest, committees struggle when determining with whom they should partner. Unfortunately, the best answer for both questions is: “it depends.” In terms of the latter, there are several important considerations:

Longevity of Team

Relationships are important. Understand the composition, experience, and network of the team that sources your private capital opportunities.

Manager Selection & Access

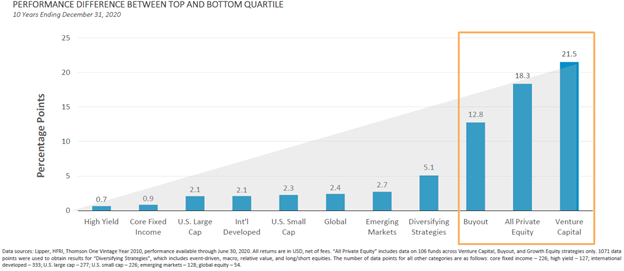

This is of the utmost importance, as the dispersion of returns between top- and bottom-quartile private equity managers over time tends to be drastic, averaging 18% for the past 10 years.

Diminishment by Capacity: Size Matters

Even if a firm offers access to top-tier managers, you must also verify whether the firm can offer your institution the capacity you desire. Institutions can be squeezed out of top-tier private capital managers due to capacity constraints placed on their advisor or OCIO. For example, limited partners are only allotted a certain amount of capacity by managers. Knowing the optimal commitment size per allocation and working with an experienced—or long-tenured—advisor or OCIO who focuses on that same sweet spot can improve your chances of gaining access to desirable opportunities.

Implementation Approach

Fund of fund products may be easier to implement and less complex for the back office compared to direct fund investments, but these products lack optionality and are often more expensive for the investor.

How Much Private Capital?

There are two components that must be blended to properly address the private capital allocation decision. The first involves evaluating your liquidity needs, while the second focuses on establishing the desired target return and understanding the risk/return trade-off.

Private capital investments come with lockups and capital calls, which can be hurdles for institutions that have annual spending needs. Smaller institutions may even require added flexibility to draw on their endowments in times of economic turmoil.

What is your desired target return for the next 10 years and how much risk is allowable to achieve your return objective? Having worked with boards for decades, FEG is skilled at helping organizations answer these questions and align return needs with ability and willingness to take risk.

How to Implement Private Capital

As in all matters of portfolio construction, diversification is key. Institutions should aim to diversify across private capital asset classes—i.e., private equity, private debt, private real estate—but also within asset classes, for instance across vintage years, regions, and strategy types. FEG further focuses on mitigating and shortening the “J-curve” effect, which occurs when private market funds deploy capital in their early years and investors fail to see short-term returns.

Incorporating Private Capital into Your Portfolio

According to the National Association of College and University Business Officers, the average long-term target return of college and university endowments is approximately 7-7.5%, and the average annualized endowment return from 2011-2020 totaled 7.5%. Continuing to meet this target will likely require universities to incorporate new investment strategies however, despite current extremes in valuations in U.S. equities following the largest 12-month S&P 500 return on record, fixed income rates remain ultra-low.

FEG’s proprietary asset class projections suggest returns from traditional asset classes may fall below 6% over the next 10 years. In fact, a 60-40 portfolio made up of public asset classes might only return 4-5% before inflation. Facing an average spending level of 4.5% and rising expectations of inflation, many institutions are wondering how they can see even a 7% return.

Working with an advisor or OCIO that can meet your needs and help you thoughtfully construct a private capital program can be a great way to add return where traditional asset classes may fall short.

Visit www.feg.com to learn more about how your institution can begin incorporating a private capital investment strategy.

This report was prepared by FEG (also known as Fund Evaluation Group, LLC), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directly to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202, Attention: Compliance Department.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it. FEG, its affiliates, directors, officers, employees, employee benefit programs and client accounts may have a long position in any securities of issuers discussed in this report.

FEG Capital Market Assumptions are the result of hypothetical allocations constructed under various assumptions of various constraints and liquidity needs, and allocations may not be appropriate for all investment objectives. All projections provided are estimates and are in U.S. dollar terms, unless otherwise specified, and are based on data as of the dates indicated. Given the complex risk-reward trade-offs involved, one should always rely on judgment as well as quantitative optimization approaches in setting strategic allocations to any or all of the asset classes specified. Please note that all information shown is based on qualitative analysis developed by FEG. Exclusive reliance on the above to make an investment decision is not advised. This information is not intended as a recommendation to invest in any particular asset class, product, security, derivative, commodity, currency or strategy or as a promise of future performance. Please note that these asset class and strategy assumptions are passive only—they do not consider the impact of active management. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell any securities, commodities, derivatives or financial instruments of any kind. Forecasts of financial market trends that are based on current market conditions or historical data constitute a judgment and are subject to change without notice. We do not warrant its accuracy or completeness. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for, accounting, legal, tax, investment or tax advice. There is no assurance that any of the target prices mentioned will be attained. Any market prices are only indications of market values and are subject to change.

Index performance results do not represent any managed portfolio returns. An investor cannot invest directly in a presented index, as an investment vehicle replicating an index would be required. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.

Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

Any return expectations provided are not intended as, and must not be regarded as, a representation, warranty or predication that the investment will achieve any particular rate of return over any particular time period or that investors will not incur losses.

Matt Finke is the Vice President of FEG Investment Advisors

References and Resources

- PODCAST: Renewing Energy Investments

- PODCAST: Nothing Ventured…Nothing Gained: Navigating Asian Venture Capital Markets

- AGB RESOURCES: Private Capital

With Thanks to AGB Sponsor: FEG Investment Advisors

Matt Finke

Vice President

FEG Investment Advisors

mfinke@feg.com