Opinions expressed in AGB blogs are those of the authors and not necessarily those of the institutions that employ them or of AGB.

At the recent 2021 AGB Foundation Leadership Forum, Martin Davies discussed why it is a compelling time to invest in farmland.

Considered a reliable asset class, farmland has proven to be a dependable store of value through times of economic tumult driven by the essentiality of food for survival to a growing population, supplied by a limited land resource base -exhibiting durable valuations and attractive levels of income.

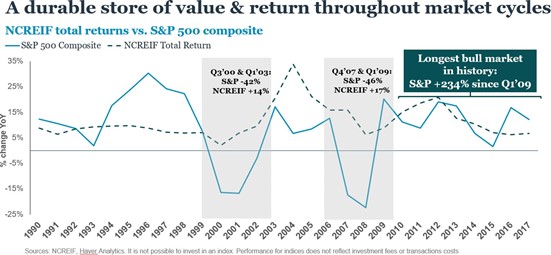

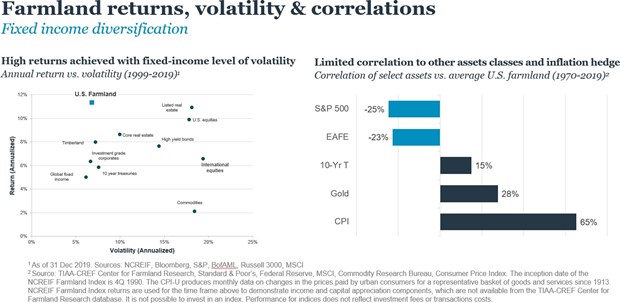

Over time, agricultural investment performance has moved in different cycles from traditional asset classes such as stocks and bonds; as a result, adding farmland to a portfolio enhances diversification and can result in lower volatility.

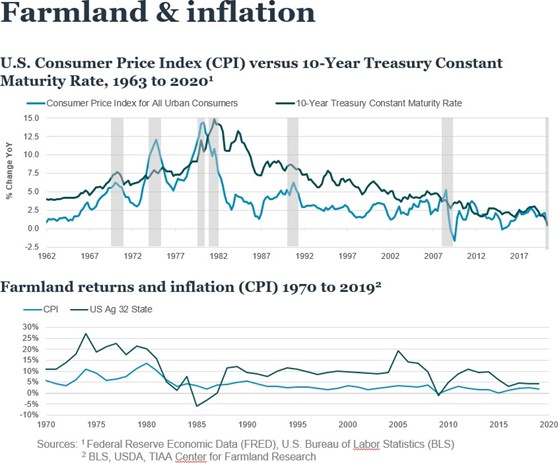

Recent posture and guidance of the FED signals accommodation or promotion of inflationary targets. Farmland is one of the greatest stores of real value in periods of inflation.

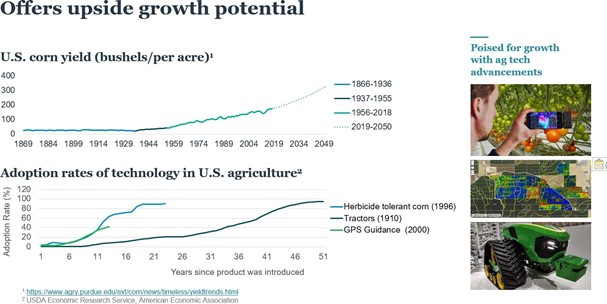

Independent of the benefits farmland offers to portfolios in light of the impacts of coronavirus, it is a compelling time to invest in agriculture due to expected imminent productivity gains as new technologies come to market.

This material is presented for informational purposes only and may change in response to changing economic and market conditions. This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or investment strategy, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor or suggest any specific course of action. Financial professionals should independently evaluate the risks associated with products or services and exercise independent judgment with respect to their clients. Certain products and services may not be available to all entities or persons. Past performance is not indicative of future results. Farmland investments are less developed, more illiquid and less transparent compared to traditional asset classes. Investments will be subject to risks generally associated with the ownership of real estate-related assets and foreign investing, including changes in economic conditions, currency values, environmental risks, the cost of and ability to obtain insurance and risks related to leasing of properties.

Theresa Goldberg is a senior portfolio client specialist at Westchester Group Investment Management, Inc. from Nuveen.

References and Resources

- REPORT: Second Quarter 2020: [Update] Why farmland now?

- PAPER: TIAA Center for Farmland Research: The relationship between inflation and farmland returns

- FLF SESSION: Why Invest In Farmland Now?

- FLF PRESENTATION: Why Invest In Farmland Now?

- WEBSITE: Westchester Group Investment Management

With Thanks to AGB Sustaining Sponsor: TIAA

Theresa Goldberg

Senior Portfolio Client Specialist

Westchester Group Investment Management, Inc. from Nuveen

TGoldberg@wgimglobal.com