- Long-term financial plans that are aligned with strategic institutional priorities, and consequent frameworks, are indispensable enablers of effective governance by finance committees.

- Such plans should support long-term cash neutrality by integrating hidden liabilities of the institution, such as capital renewal and faculty salary-related costs, and thus help with strategic decision making.

- The new Council of Finance Committee Chairs, which was convened by AGB and Huron, is discussing key financial challenges of colleges and universities and the role of finance committees in helping institutional leaders to address them.

Convened by AGB and Huron, a new Council of Finance Committee Chairs is discussing major financial issues in higher education and the role of trustees in helping college and university leaders address them.

College And University leaders, along with their board members, are working to confront a variety of financial challenges, many of which predate the pandemic. These issues—including rising demand for financial aid, student health and wellness needs, demographic changes, cultural polarization, increased workforce demands, and (most recently) inflation—have boards and institutional leaders feeling more pressure than ever. In a recent survey by the Association of Governing Boards of Universities and Colleges (AGB), trustees noted that increased scrutiny by the campus community, the media, and the public, as well as increasing levels of transparency, have added to the increased complexity of their roles.

While financial pressures existed before the COVID-19 pandemic, the past two years have accelerated the need to address these issues at many colleges and universities, pressuring institutional leaders and trustees to act quickly, without optimal time and structures to think or plan more strategically. What do we need to do to build or sustain long-term strength and viability, while also further investing in and promoting distinct value propositions in this new landscape?

Institutional leaders often must focus on and strengthen how they differ from other institutions to successfully attract a specific student, faculty, and staff profile. Such differentiation typically requires certain aspects of an institution’s operating model to improve or change—whether it is its academic portfolio, faculty capacity for innovative teaching and research, or investments in service delivery and technology support. While there are a variety of ways for institutions to differentiate themselves, investments in unique strengths and core mission-related initiatives can create the best opportunities for success.

To plan effectively for both the short and long term, institutional leaders must work with their boards to design a planning paradigm that addresses the changing higher education landscape, while anticipating the greatest strategic opportunities and competitive challenges facing their institutions. This can require an analysis of the institution’s current operating model, including carefully evaluating activities that may not be financially sustainable and/or strategically aligned with the institution’s future. To do so requires board engagement, as well as the development of a framework to support long-term financial sustainability aligned with strategic priorities.

Hidden Liabilities Complicate a Full Understanding of the Model

In higher education, a variety of financial decisions and the related long-term implications are not commonly transparent from an institutional balance sheet. Capital renewal (often referred to as deferred maintenance) is one example, and is a common, seemingly ever-pressing, issue for colleges and universities. Capital-renewal needs in higher education almost always represent facility or construction needs or projects that have not been addressed due to competing priorities in previous budget cycles.

Many campuses, adorned with scenic buildings and landscapes, reflect the generosity of donors over many years. While an integral part of the college experience, these facilities hide recurring maintenance costs that may not have been considered when the facilities were first constructed. As time passes and renewal needs are not addressed, the risk that something happens to a building or a facility increases, which in some instances results in the institution having no choice but to act urgently to rectify issues. Such after-the-fact interventions are more costly than the renewal activities that are forgone in early years. As a result, unaddressed capital renewal needs snowball over time as even more state-of-the-art facilities are donated and built.

Another example of hidden liabilities for many colleges and universities is salary obligations. Compensation represents the bulk of most institutional operating budgets, accounting for 60 percent to 70 percent of annual spending at many institutions, and faculty salaries represent a large share of the compensation expense line.

Therefore, decisions about tenured faculty commitments—as well as an institution’s academic offerings—warrant specific focus within any long-term financial planning framework. Such decisions require a balance between ensuring the institution can continue to invest in and grow its academic and faculty base and more proactively establishing retirement programs for those in the latter stages of their careers.

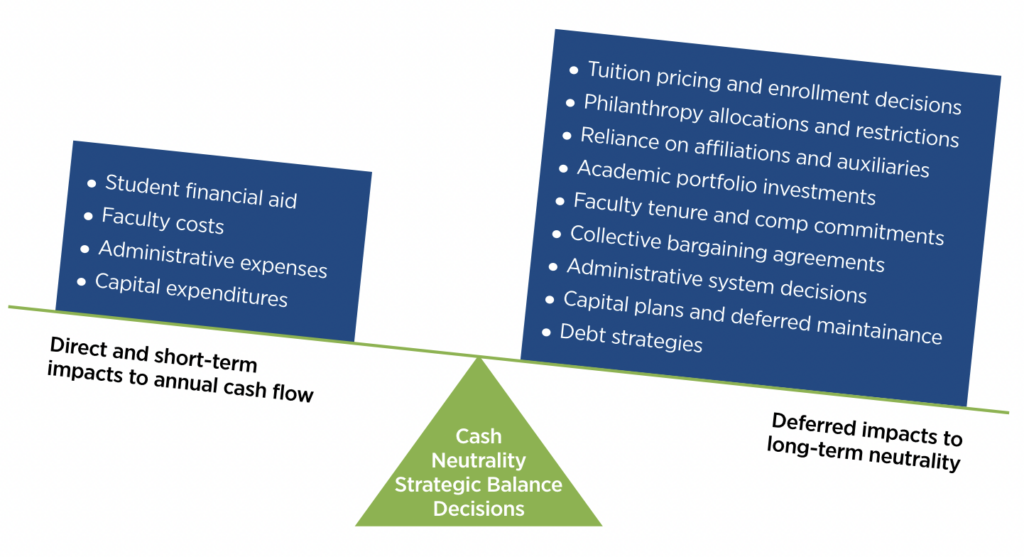

Given these realities, near- and long- term strategic planning are critical for achieving a long-term cash-neutral balance (see figure 1). Strategic financial management needs to go beyond approving a budget for a single year of operations. By planning years ahead, university leaders and trustees can make well-informed decisions on items having long-term implications— such as capital renewal, tenure obligations, and academic portfolio offerings—and better evaluate the institution’s current resources, how they should best be deployed, and how to link financial investments to the institution’s overall strategic priorities.

FIGURE 1: Near- and long-term strategic planning to achieve a long-term cash-neutral balance

Balancing Mission and Strong Financial Management

Many industry pundits point to endowments or philanthropy as the panacea to cover the long-term financial obligations of colleges and universities. Yet only a small number of colleges and universities have access to the kind of endowment wealth that makes headlines. The Education Trust, a nonprofit that seeks to reduce opportunity gaps for students of color, calculated that roughly 3.6 percent of colleges and universities hold 75 percent of postsecondary endowments. And because many institutions direct their donors to specific and immediate needs such as financial aid or operational support, philanthropic support is not a consistent resource for addressing long-term financial commitments or investing in transformative initiatives.

Linking an institution’s financial plan with the long-range strategic plan and ensuring that resources are applied to support the planning priorities is incredibly important today. At some institutions, this is accomplished by aligning the institutional needs with the foundation’s funding plan to ensure critical programs are supported. One challenge is what type of “future” planning institutions should be doing as the delivery model for education programs evolves and technology becomes more essential than bricks and mortar—especially post-COVID-19.

At the start of the COVID-19 pandemic in early 2020, higher education leaders sought to ease critical financial stress by introducing pay cuts, furloughs, and layoffs, yet many cuts potentially impede future success, growth, and even an institution’s reputation. When colleges and universities are in crisis mode, as many were at the beginning of the pandemic, leaders are forced to make difficult mission-impacting decisions regarding academic programs. Now is the time to put more structures in place to help make better-informed decisions along the way, using available data with a full understanding of the trade-offs involved.

Leaders benefit from leveraging a framework that provides financial transparency and a long-term perspective for balancing competing priorities. A key challenge is how to make decisions about current expense reductions without affecting quality and brand, as well as how to invest in the short term without creating excess hidden long-term liabilities. Conversely, institutions must assess whether near-term resource allocations into the academic portfolio or investments in new initiatives will generate long-term revenue growth and/or positively impact the quality of the organization’s academic mission.

The Council of Finance Committee Chairs

To promote collaborative discourse on the many complicated challenges facing higher education and the role of finance committees in helping to address them, AGB and Huron, a global consultancy with expertise in higher education, created and convened the Council of Finance Committee Chairs (Finance Council) in 2021.With quarterly meetings, the finance council brings together finance committee chairs, chairs-elect, and vice chairs from AGB member institutions to discuss issues of specific and strategic relevance to finance committees of boards of trustees. Outcomes from these discussions will be periodically shared with AGB members via Trusteeship magazine articles, podcasts, and events such as the AGB Annual Meeting.

During recent meetings, council members agreed that trustees are generally well versed in trade-off decisions and long-term planning outside of the education industry sector. Nonetheless, many trustees recognize that they need additional context and transparent understanding of financial issues unique to higher education, noting that just because certain institutional models have historically operated in a specific manner does not mean they cannot and should not change in the future.

Many of the institutions represented on the council have taken important steps toward a multiyear financial planning framework—including views into cash flows and changes in the balance sheet— instead of solely relying on annual operating budgets to make decisions. Yet there has been a pragmatic realization that the practice of integrating uncertainties into financial models is still evolving, especially given the unprecedented shifts in the higher education landscape.

Long-term financial commitments— typically understated during annual discussions on proposed operating budgets but critical to the long-term cash neutrality position of institutions—need to be anticipated, planned for, and integrated into strategic plans so that boards can make well-informed judgment calls based on management’s direction.

Given these factors, how do leaders better prepare for a sustainable future in the face of industrywide headwinds?

Council members stressed that when developing an institutional long-range financial plan, it is imperative that the board and administration have an honest discussion about baseline requirements and resource availability. It is essential that the priorities are clearly stated, and that the strategies that are employed support their attainment. One approach to establishing the priorities is to identify goals and issues as a precursor to the strategic planning process. The business unit, like the board, would present its key strategic goals over the planning period like market share, growth, products/services to be provided, etc., to the center, i.e., the administration. This front-end to the planning process helps achieve general alignment between the center and the business units before the unit planning process starts.

This approach can be summarized in a strategic planning framework that optimizes collaboration and resource alignment with strategic priorities to create greater impact on their missions.

When engaging in these conversations, it is best to speak with trustees on the underpinnings of any decisions made by management in order to have transparent conversations that can lead to more effective strategic planning and resource allocation. With the many uncertainties continuing to cause disruption across the higher education industry, institutions may readily fall back into crisis mode and make cuts that can harm the mission and impact of a college or university. Yet, by anticipating these future disruptions and more fully understanding the institution’s liabilities in planning and long-term financial projections, trustees and leaders can work together to build a more fruitful and sustainable future.

Tim Walsh, Managing Director, Huron, specializes in financial and strategic planning, administrative and technology-enabled efficiency, and intercollegiate athletics. Prior to joining Huron, he was the Vice President of Finance and Treasurer at Duke University.

Jaime Ontiveros, Managing Director, Huron, specializes in budget redesigns, financial analyses, governance models, mobilizing large integrated cross-functional initiatives, and optimizing resource allocation, management, and planning. Prior to his current role, Jaime served in the United States Army Reserves as a staff sergeant and received an honorable discharge.

Robert Spencer, Principal, Huron, advises on strategic financial planning, mergers and acquisitions (M&A) agreements, financial assessments, financial reporting, budget modeling and administrative operational improvement initiatives.