Opinions expressed in AGB blogs are those of the authors and not necessarily those of the institutions that employ them or of AGB.

Commonfund has been partnering to produce industry insights and thought leadership across the nonprofit institutional investor space for decades. Central to these efforts have been benchmark studies of investment governance practices and policies of endowments: the NACUBO-Commonfund Study of Endowments (NCSE), the Commonfund Benchmarks® Study of Independent Schools (CSIS), and the Council on Foundations-Commonfund Study of Investment of Endowments for Private and Community Foundations (CCSF).

The studies equip boards and investment committee members with data on key trends and analysis related to important investment topics, allowing institutions to put their policies and practices in the context of their peers and the field. At Commonfund Forum 2024, George Suttles, executive director of the Commonfund Institute, Allison Kaspriske, director of the Commonfund Institute, and Ken Redd, senior director of research and policy analysis at the National Association of College and University Business Officers (NACUBO), presented trends across the aforementioned benchmark studies and discussed related governance insights. This blog post highlights the key trends and commentary they provided.

Returns

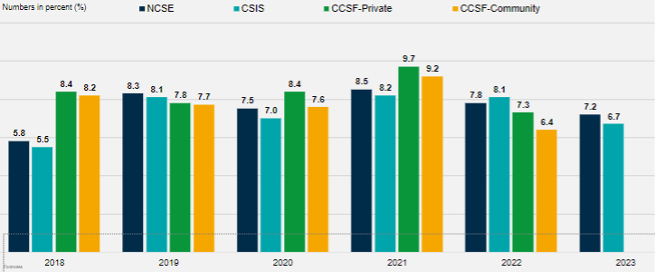

One-year returns reflect the change in value of a total endowment from one year to the next. They are a direct reflection of the performance of the asset classes across institutions’ portfolios on average. Institutions often want to know how they’ve performed by this metric relative to their peers and may use it as a tool for rebalancing considerations over time if the data show they are consistently underperforming year over year. However, it is important to note that as long-term investors, institutions should view the one-year return as only one means of gauging their performance and adherence to their return objectives. The one-year return can also be a tool for public relations and communications with various stakeholders, whether the news is positive or negative.

The panelists stressed that the longer-term returns, five- and 10-year, are the data points that can really reflect whether an institution is on track to meet long-term objectives through its investments. Long-term returns can help level-set expectations and inform decision-making around spending, for example to determine whether an institution’s spending rate is sustainable, given trends in long-term returns. Moreover, this is only one of many factors that enable board members and investment committees to guide their institution toward long-term success.

10-Year Returns by Segment and Year

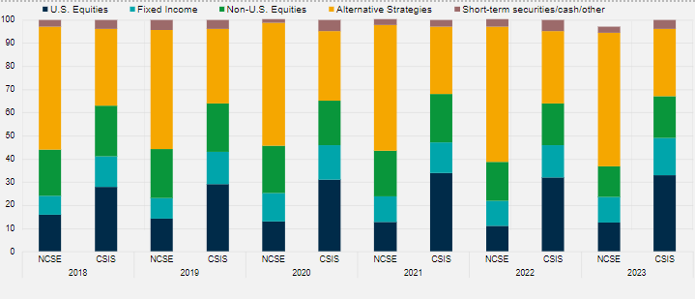

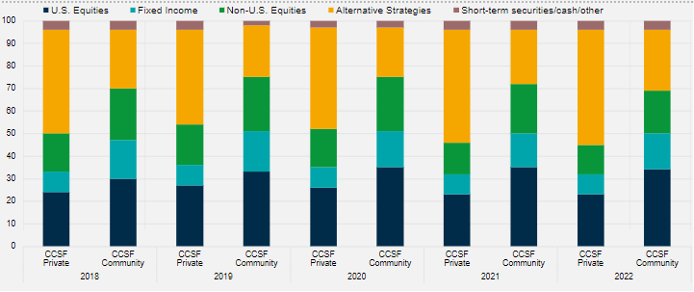

Asset Allocation

The NCSE data show that average allocations to equities (U.S. and non-U.S.) have been decreasing over time for higher education institutions as they allocate greater portions of their portfolios to alternative strategies. Higher education institutions have the highest allocations to alternative strategies of any cohort we survey. Meanwhile, independent schools have reported slight reductions in their alternatives allocations over the past five years, and private and community foundations have slightly increased them. We also know that, across studies, larger endowed institutions tend to have higher allocations to alternative strategies than smaller ones, which, in most study years, contributes to their financial outperformance.

Panelists advised each institution to determine its asset allocation policy based on its own liquidity needs, risk tolerance, and mission. For example, in both NCSE and CSIS, the top use of endowment reported by respondents in FY23 was for need-based financial aid—for which annual funding is critical. Asset allocation is contingent upon these key questions, such as how much liquidity is needed to cover these important uses of endowments while maximizing return potential. This comes with the caveat that there are different liquidity profiles across suballocations within each strategy, including within alternative strategies.

Average Asset Allocations for Higher Education and Independent Schools, by Year

Average Asset Allocations for Private and Community Foundations, by Year

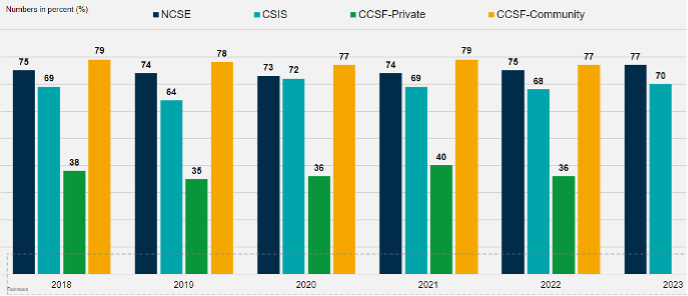

Fund Flows

Spending is the link between the endowment and the institution, and the Commonfund studies track it in a variety of ways. One key approach to understanding spending is through an institution’s spending policy. A majority of institutions of higher education, independent schools, and community foundations reported that they use a percentage of a moving average methodology to determine their spending. For example, 77 percent of NCSE (FY2023) respondents and community foundations (CCSF 2022) reported using that methodology, as did 70 percent of independent schools (FY2023). Meanwhile most private foundations reported using the IRS-mandated minimum of 5 percent as their spending policy.

These policy trends have been relatively consistent over time since spending changes can have significant implications for the institution and its constituents. However, it is important for institutions to consider spending policy as a potential tool to help smooth endowment values, especially amid market volatility and inflation.

Share of Respondents Using a Percentage of a Moving Average Spending Methodology

Gifts, while unique to each institution, tend to be inconsistent, typically following the volatility of the markets. Across all studies in more than half of the past 10 years, however, participating institutions have reported an increase in gifts. Panelists suggested that gifts are important for sustaining endowments and that telling a story of their endowment’s use (how it is used to meet mission and how it is being governed responsibly) can in turn increase trust and transparency, and bolster fundraising efforts.

Responsible Investing

The NCSE has been surveying institutions of higher education on responsible investing practices since environmental, social, and governance (ESG) became common terminology, while CSIS and CCSF started asking questions on responsible investing more recently. The studies ask about ESG, negative screening, impact investing, and diverse manager practices within the investment policy statement (IPS) and in boardroom discussions, whether these themes are important in due diligence of investment managers, and more. While positive responses have increased dramatically over the years, we have seen evidence of a leveling off in recent studies.

Panelists shared two key insights. First, many institutions are doing a lot of socially responsible development outside of the investment sphere. In other words, even if they do not report ESG or impact investments in their portfolio, that does not mean they are not actively improving their local communities through other means. Second, the opportunity set for responsible investing has grown dramatically. Whereas the key strategy decades ago was screening out “sin stocks,” now there are sophisticated tools for capturing ESG risks and opportunities, and directing investments to address local issues of concern.

Outsourcing

According to the findings of Commonfund benchmark studies, the use of an outsourced chief investment officer (OCIO) has been increasing across all segments over the past 10 years, especially in the higher education segment. Outsourcing certain management functions can include support with investments as well as administrative, back office, and fundraising support, and can range from the use of a consultant to a fully outsourced chief investment office. Partnering in these ways can provide access to investment talent, free up in-house resources for other functions, or even reduce staffing needs to ultimately lower costs.

Panelists noted that due to resource constraints, it is more common for smaller institutions to use outsourced partners; typically, only relatively large institutions have an internal chief investment officer. They stressed that freeing up internal resources benefits the institution’s capacity for high-level strategic thinking and direction setting, whereas, for example, conducting due diligence on investment managers may not be the best use of a board’s, investment committee’s, or staff member’s time.

Lastly, panelists emphasized that outsourcing certain investment functions does not mean relinquishing an institution’s fiduciary duties of loyalty and care. Internal governance functions related to determining investment policies as well as regular oversight are required to best meet the institution’s mission and needs.

Commonfund benchmark studies encompass rich data and analysis that capture key items of concern across the nonprofit institutional investor space. We strive to continue to track and uncover new and long-term trends and tell the nuanced stories of why governance matters to endowment investment management.

George Suttles is executive director of the Commonfund Institute. Allison Kaspriske is director of the Commonfund Institute. Amanda Novello is senior policy and research analyst of the Commonfund Institute.

With Thanks to AGB Mission Sponsor: Commonfund