Opinions expressed in AGB blogs are those of the authors and not necessarily those of the institutions that employ them or of AGB.

For an endowment or other perpetual pool of capital, the ability to grow the portfolio, net of spending, expenses, and inflation, is critically important to supporting future generations. Despite predictions in recent years of a “low return environment” that could limit that growth, the bull market that began in 2009 continued through 2021, with only a brief pause at the onset of the COVID-19 crisis. Endowments have benefited, earning 8.3 percent over the past decade, and 11.7 percent from 2019 to 2021, the highest growth over a three-year window since 2007. With core inflation averaging close to 2 percent during those periods, returns outpaced spending, inflation, and expenses.[1]

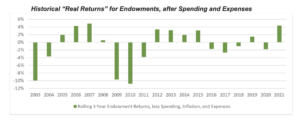

Endowments face a different landscape in 2022. With inflation spiking to 40-year highs and recession fears increasing, endowment and foundation boards may need to consider the impacts associated with a “low real return environment,” with the term “real” referring to returns adjusted for the impact of inflation. Assuming 5 percent spending and expenses[2] and 3.0 percent inflation (the level the market is currently projecting for the next five years[3]), a portfolio would have to return 8 percent just to break even from a real return perspective. If we look in the rearview mirror, 40 percent of endowments would have failed to earn a return above 8 percent over the prior 10 years—a strong period for markets—and more than 70 percent would have failed to do so over the past 20 years.[4] Of course, actual inflation was lower (closer to 2 percent) during those periods, moving the return benchmark closer to 7 percent. Even so, data suggest that endowments still went through extended periods with negative real returns, net of spending and expenses, as shown in the chart below.[5]

If higher inflation persists, endowments and foundations may be challenged to generate positive real returns for extended periods. Boards and investment committees may need to adjust their endowments’ investment programs to preserve intergenerational equity. We offer these five suggestions for consideration:

- Be willing to adapt. The portfolio that “worked” over the past decade might not be the best one for a market regime characterized by higher rates, higher inflation, less liquidity, and lower stimulus. Investment committees should be willing to embrace—not fear—meaningful shifts in their portfolios.

- Consider increased exposure to real assets. Real assets have been a laggard for years relative to traditional equities. For example, commodities have had a cumulative return of -0.8 percent since 2010, a period that saw the S&P 500 increase a staggering 373%.[6] We believe that gap is poised to shrink, and possibly invert in coming years. Hard assets such as commodities and real estate may provide a hedge against inflation, and the geopolitical backdrop may lend additional support through accommodative energy policies and a potential revival of domestic manufacturing as globalization takes a pause.

- Revisit key themes within equity portfolios. The past decade favored a tilt toward domestic growth exposure. From 2012 to 2021, growth stocks outpaced value stocks by almost 7 percent per annum, and domestic stocks outpaced international stocks by over 8 percent.[7] With the market environment poised to change, value and international stocks may offer better returns in the years ahead. The past decade also saw the rise of passive investing as active managers struggled to beat major indices like the S&P 500. That trend, too, could reverse as active managers find an improved opportunity set relative to indices that have grown more concentrated in certain names and sectors.

- Seek income from higher yields. The Bloomberg Global Aggregate Bond index posted losses for a record nine-straight months from August 2021 to April 2022 as yields rose across the fixed-income universe. Going forward, higher yields would equate to more income for investors. As an example, the yield for high-yield bonds had risen to almost 8 percent as of mid-May, equivalent to the average yield over the past 20 years.[8]

- Be opportunistic. Volatile markets can create opportunities for long-term investors. The S&P 500 has fallen by an average of 30 percent during the 12 recessions since World War II.[9] Investors willing to step in during those difficult environments benefited from attractive long-term entry points. Opportunities may also appear in niche areas. For example, the technology sector in China and the biotechnology sector in the United States have already experienced large corrections. Both had fallen more than 60 percent from their 2021 highs through mid-May.[10] Even in a market that broadly favors “value,” investors may have opportunities to buy “growth” at lower valuations and thus enhance expected long-term returns.

Since the great financial crisis in 2009, returns have been boosted by a benevolent combination of low interest rates, low inflation, and high levels of stimulus, all of which pushed equity and fixed-income markets higher. However, with inflation hitting levels not seen in over 40 years, the market environment appears poised for a pronounced regime change. Institutional investors should be prepared to meet the challenges that a low real return environment presents.

Darren Myers is a partner and director of research at Agility.

1Source: 2021 NACUBO-TIAA Study of Endowments and predecessor reports back to 2001, Agility estimates, and the Federal Reserve Bank of St. Louis. Time periods reflect fiscal years ended June 30. Annualized return for the median respondent to the 2021 NACUBO-TIAA Study of Endowments.

2Source: 2021 NACUBO-TIAA Study of Endowments.

3Source: Bloomberg for 5-year breakeven inflation as of 5-25-22.

4Source: 2021 NACUBO-TIAA Study of Endowments and Agility estimates. Time periods reflect fiscal years ended June 30.

5Source: 2021 NACUBO-TIAA Study of Endowments and predecessor reports back to 2001 and Agility estimates. Chart reflects average endowment performance, adjusted for the effective spending rate and core CPI for each fiscal year, and a 0.5% annual expense assumption.

6Source: Bloomberg for the Bloomberg Commodity Index and S&P 500 Total Return Index from 1-1-10 to 4-30-22.

7Source: Bloomberg from 1-1-12 to 12-31-21. Indices used are: Russell 1000 Growth Total Return index (growth stocks), Russell 1000 Value Total Return Index (value stocks), S&P 500 Total Return Index (domestic stocks), and MSCI EAFE Total Return Index (international stocks).

8Source: Bloomberg (for the Bloomberg Global Aggregate Bond Index) and the Federal Reserve Bank of St. Louis (for high yield). High yield data is based on the yield on 5-19-22 (7.72%) vs. the average from 1-1-03 to 5-18-22.

9Source: Goldman Sachs.

10Source: Bloomberg. Data is calculated for the Hang Seng TECH Index (from 2-16-21 to 5-24-22) and S&P Biotechnology Select Industry Total Return Index (2-8-21 to 5-24-22).

DISCLOSURES:

Perella Weinberg Partners Capital Management LP (“Agility”) is a registered investment adviser. All information presented herein is as of the date indicated and is solely for informational purposes. The information may involve our views, estimates, assumptions, facts and information from other sources that are believed to be accurate and reliable—any of which may change without notice. Any assumptions, commentary, thoughts, or ideas where a specific source is not referenced should be assumed to be that of Agility. There can be no assurance that such thoughts will prove accurate or materialize and the commentary is not a recommendation for an investment in any trading strategy or asset allocation.

Past performance is not indicative of future results. Index data is provided to represent the market environment; an investment cannot be made directly in an index. For more information on indices visit https://www.agilitycio.com/index-definitions.

Investments discussed herein may be speculative and involve a high degree of risk; could result in loss; and may have volatile performance. International investments are subject to political influences, currency fluctuations and economic cycles unrelated to those affecting domestic financial markets and may experience wider price fluctuations. Fixed income investments are subject to interest rate, inflation, credit and default risk; as interest rates rise, bond prices usually fall, and vice versa. Real estate investments are sensitive to changes in real estate values, taxes and regulations. Commodity investing involves substantial risk of loss.

NACUBO data contained herein is published with the permission of The National Association of College and University Business Officers (“NACUBO”), a leading source of information for campus business and finance professionals. Agility is a corporate partner member of NACUBO and is a sponsor of NACUBO’s 2022 Endowment Leadership Forum. For additional information about NACUBO please see https://www.nacubo.org/. The 2021 NACUBO-TIAA Study of Endowments, which is available for purchase, provides an analysis of endowment investment returns, asset allocations, and governance policies and practices at hundreds of U.S. higher education institutions and affiliated foundations. Certain Agility clients may have participated in the study. For more information, please see https://products.nacubo.org/index.php/leadership/2021-nacubo-tiaa-study-of-endowments.html.

With Thanks to AGB Mission Sponsor: Agility