Opinions expressed in AGB blogs are those of the authors and not necessarily those of the institutions that employ them or of AGB.

In my 25 years at RNL, I’ve spoken to nearly 100 college/university boards about enrollment issues. These sessions are always engaging. That said, I often leave thinking, “There are critical enrollment-related conversations boards don’t seem to be having with their institutions.” I’ve come to suspect these result from the lack of a structured agenda for facilitating ongoing conversations about enrollment strategy. In many cases there’s not even a dedicated enrollment subcommittee.

To put this in perspective, imagine a corporate board with no process for understanding and discussing a company’s product, go-to-market, pricing, and customer acquisition/retention strategy. I’m not suggesting these issues don’t receive attention from college/university boards, but I see they are often fragmented and/or infrequent discussions that focus superficially on the latest “numbers” or what the sticker price should be. With that as backdrop, allow me to suggest four critical questions that boards should be asking and collaborating with senior leadership on.

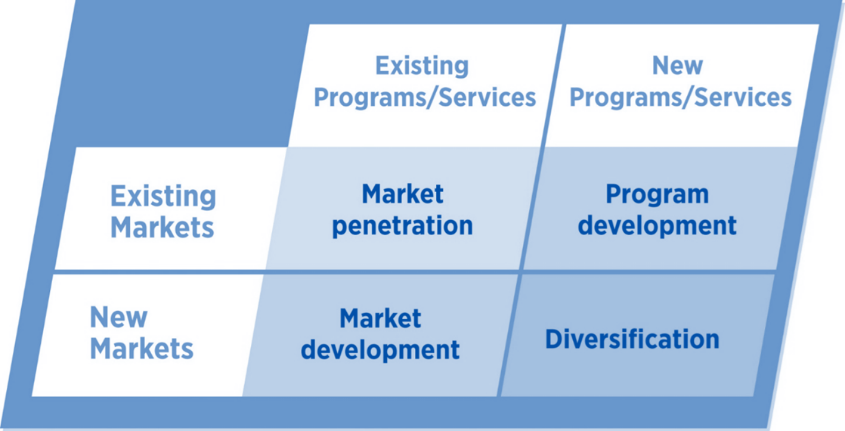

Does your institution have a comprehensive enrollment strategy that contains a blend of initiatives across the four quadrants depicted below?

Many of you are familiar with Ansoff’s matrix, below, which suggests that any organization has four broad ways to stimulate demand: increasing market share, introducing new/revised programs inside and outside the classroom (product strategy), developing new markets, and pursuing diversification tactics (new programs/new markets).

At any given time, an institution should have 8-15 higher-order enrollment strategies distributed across at least three of the four quadrants. We generally recommend schools avoid the diversification quadrant because the risk of failure is much higher. These initiatives should be articulated in action plans that clearly document expected enrollment/fiscal outcomes of each strategy over a 3-5- year time frame. This is the core output of a strategic enrollment planning process and boards should be highly familiar with these strategies, how they are progressing against targets, and the next set of strategies planned to launch.

Is your institution aggressively managing its price position, discount rate, and enrollment-related net-operating revenue?

The last decade has witnessed a significant flattening of net tuition revenue among four-year privates and increased dependence upon net tuition revenue in the public four-year sector. Tuition discounting is widespread in both sectors and rising steadily. These trends are likely to accelerate as federal/state governments wrestle with the economic impact of COVID-19 and families are less able to direct discretionary income for college-related costs.

This makes it imperative for boards to understand their institution’s net pricing strategy and related metrics: tuition discount rates and the overall discount rate and net revenue when auxiliary services revenue is included. The crisis has brought the realization that many schools have become dependent on auxiliary revenue when students were forced from dorms. I’ve observed some boards, overly focused on the tuition discount rate, contribute to declines in their net tuition revenue because they don’t understand the interplay between enrollment levels, discounting, and net revenue. The opposite can also occur wherein a school erodes net tuition in the frantic support of enrollment growth or unrealistic shaping objectives.

Are your retention and completion rates within norms?

Nationally, first-to-second-year retention rates average 81% in the four-year sector (public/private) with approximately 60-65% of students graduating within six-years. However, there is considerable variation in these outcomes based upon the kinds of students served, region of the country, setting, and institutional level/mission. Boards and executive teams should collaborate to develop a set of comparative institutions to benchmark performance, have clear strategies for achieving desired retention/completion rates, and share a mutual understanding of the variables correlated to student attrition on your campus.

Moreover, most schools focus almost exclusively on these rates for first-time college students, ignoring populations that often make up much larger proportions of the population such as transfer, adult reentry, and graduate students. As online learning grows, it is critical to manage differential performance by modality because the truth is, while we have mastered many aspects of online education, RNL data shows that students are dissatisfied with many aspects of their online learning experience.

Is your institution effectively managing the transition to new learning modalities in response to student demand?

Thirty-five percent of undergraduates and 40 percent of graduate students took at least one distance course in 2018-19. The movement to more distance courses has been accelerated due to the pandemic. Managing this transition requires boards and leaders to have clear data on student preferences for course and modalities. This requires routine assessment of student preferences and actual behavior. It’s important to monitor changes in your competitor offerings so you’re not the last school to respond to shifting student demand.

That said, it’s important to recognize that most distance education is not 100 percent remote. In fact, only 14 percent of undergraduates and 31 percent of graduate students are enrolled exclusively in distance courses.

Focusing on these four critical questions can make boards more effective partners in developing an institution’s enrollment strategy.