Opinions expressed in AGB blogs are those of the authors and not necessarily those of the institutions that employ them or of AGB.

Paul Friga, PhD, is our AGB Consulting practice area leader for strategic transformation of public higher education and the clinical associate professor of strategy at the Kenan-Flagler School of Business at the University of North Carolina at Chapel Hill.

First things first, Happy Holidays! I bet all of us are looking forward to time off at the end of the month to catch our breath and get ready for 2022.

This month’s topic, financial forecasting, is bringing back a flood of memories from my days at PricewaterhouseCoopers (PwC) when I was a CPA/CMA doing financial modeling for turnaround consulting clients, and even my time at McKinsey conducting strategy consulting. Every project had an underlying financial forecasting model that included projections of revenue, expenses, and scenario analysis and typically reflected some sort of return-on-investment analysis.

My work in higher education over the past decade leads me to believe that this is less common in universities – certainly at the board level and even at the cabinet/campus level. I find many higher education leaders who put quite a bit of work into next year’s budget process but much less into multiyear planning models and forecasting. This blog dives into why this is important and key success factors to doing it well.

Why Multiyear Financial Forecasting Is Important

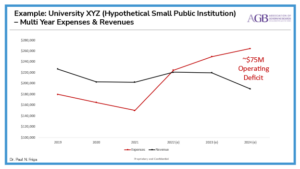

Even though the federal government has come through with significant support for our colleges and universities, the financial picture for higher education remains quite serious. About 30 percent of all higher education institutions were running operating deficits even before the effects of COVID-19 on enrollments, other revenues, and additional expenses. We need to recognize that universities have been banking on continually increasing tuition and enrollments to address the financial issues, but they will not! Only through fiscal discipline and longer-term realistic financial forecasting will we be able to address the underlying operating model challenges in our sector.

Another reason to do multiyear planning is to model out the effect of decisions we are making today. Major strategic moves such as academic program portfolio changes, mergers/affiliations, and new building investment have a natural analysis period of 3 to 10 years. Deciding whether to move forward with a new initiative should include assessing how it fits the institution’s strategy as well as how it impacts the financial model. These are the kinds of discussions that boards and cabinets should be having, rather than conversations about shorter-term operational issues. It is also a better use of a talented board of trustees, as many of them likely have experience with multiyear planning exercises as they are quite common in business sectors.

Key Success Factors for Financial Forecasting

The starting point for good financial forecasting is a review of historical numbers and baseline projections moving forward. Be sure to remove any nonrecurring items (such as federal stimulus funding for COVID-19) and include profit/loss analysis as well as cash flow for noncash transactions. There are options for how you can present expenses (functional vs. natural methods for example) but the goal should be to make it as straightforward as possible. Include all recurring revenues and expenses and segment them to clearly identify the operating margin.

On my higher education strategy projects, I usually include at least three years of historical results and three years and estimated numbers in the analysis. Shown below is an illustrative example of the starting point for a university’s multiyear planning.

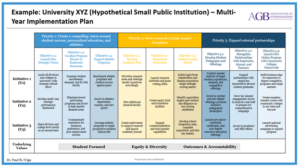

The next step is to create base, best, and worst-case scenarios of how things may develop. You should factor in such potential outcomes into financial impacts around several key metrics. It is also time to start planning ahead. The goal of strategic planning is to identify key priorities for investment to lead to positive change for the institution over the longer term. (I typically strongly suggest no more than three top enterprise-level strategies at one point in time.) Each priority should have several key initiatives, sequenced over time, usually no more than three years out in our turbulent environment. By explicitly documenting these key priorities and initiatives, the university can begin to see the roadmap for positive change. Note that the goal is not to include all operational initiatives, nor should this be micromanaged, but rather to clearly identify owners and facilitate regular reporting out.

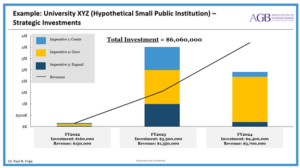

The final step is to assess the potential financial impact of the new planned strategic initiatives over the forecast period. Shown below is an example of how the implementation plan translates to anticipated expenses and potential associated revenues. This will allow for return-on-investment analysis and can be incorporated into the baseline model from above. Overall, multiyear financial analysis will be key for decision-making today and assessment of operations tomorrow!

Help from AGB

I am the AGB Consulting practice area leader for Strategic Transformation of Public Higher Education and stand by to review your current strategic plan, identify your market differentiation and consider ways to invest according to key priorities. I am available to schedule an hour call, at no cost, to review your situation — just email me at pfriga@agb.org .

Here is an article that I wrote on tips for creating budgets in these tough times: Under Covid-19, University Budgets Like We’ve Never Seen Before, and here is a past webinar that may be of interest: Preparing Your Budget with Coronavirus in Mind. Here is a great Chronicle of Higher Education Special Report that may also be helpful: Financial Strategies for the Future.

Given the urgency of the times, I am hosting a special AGB monthly workshop program, “Strategic Transformation,” exclusively for board members and presidents. Our next workshop is directly related to this topic, and we are featuring the Auburn University VP for Business & Finance/CFO and Assistant VP, Budgets & Business Operations. You can register for the December 15 2:00-3:30 pm workshop, “Financial Forecasting” here.